A review of industry and marketing trends during the 2021 Annual Enrollment Period has shown three key takeaways.

1. Overall enrollment mail dropped 4% year-over-year

Mail volume during the 2021 Annual Enrollment Period (AEP) dropped 4% compared to last year. However, because 2020 was a year that made consumers hyper-focused on health, it’s no surprise that insurers leveraged these circumstances to boost health insurance options. Insurers maintained focus on Medicare Advantage offers, which made up 74% of offers during the enrollment period. As seen in previous years, UnitedHealthcare championed offers, increasing its mail volume for the third consecutive year.

2. Insurers looked for ways to emphasize the value of their services

Insurers looked to go beyond cost by emphasizing the ways in which their health plans work for the consumer. Many insurers highlighted “choice” and “freedom” in mailers alongside a vast network of doctors, while others spotlighted rewards opportunities and five-star ratings in order to encourage prospects to enroll. Health insurers also looked for ways to stand out in the mailbox. For instance, BlueShield of California used stickers to understand where consumers were at in the enrollment process.

3. Insurers will continue to expand their ecosystems

According to the 2022 Insurance Omnichannel Trends, “Insurers will continue to develop their suite of product offerings in order to enhance their overall value to new and existing customers.” While we’ve seen this played out, insurers have the opportunity to add in educational elements to further solidify the need for these services. Not only will insurers need to showcase their ability to adapt with the changing times, but they will also need to help customers understand how these new solutions can fit into their everyday lives.

Acquisition Mail Analysis

Data shows that mail volume during the 2021 AEP (October – December) decreased by 4% year-over-year. However, volume still followed 2020’s trend, peaking in November.

Meanwhile, Medicare/Medicare Advantage offers continued to hold the bulk of mail volume, with a 74% share during the 2021 AEP, and UnitedHealthcare (UHC) not only maintained its top-mailer status, but it also increased its mail volume for the third consecutive year. Meanwhile, Aetna’s mail volume spiked in 2021, up 82% from the previous enrollment period.

Data also revealed that nine out of the top 10 mailers dedicated the bulk of its volume to Medicare/Medicare Advantage offers. Conversely, Mutual of Omaha focused mainly on Accidental Death and Cancer insurance.

Creative Review

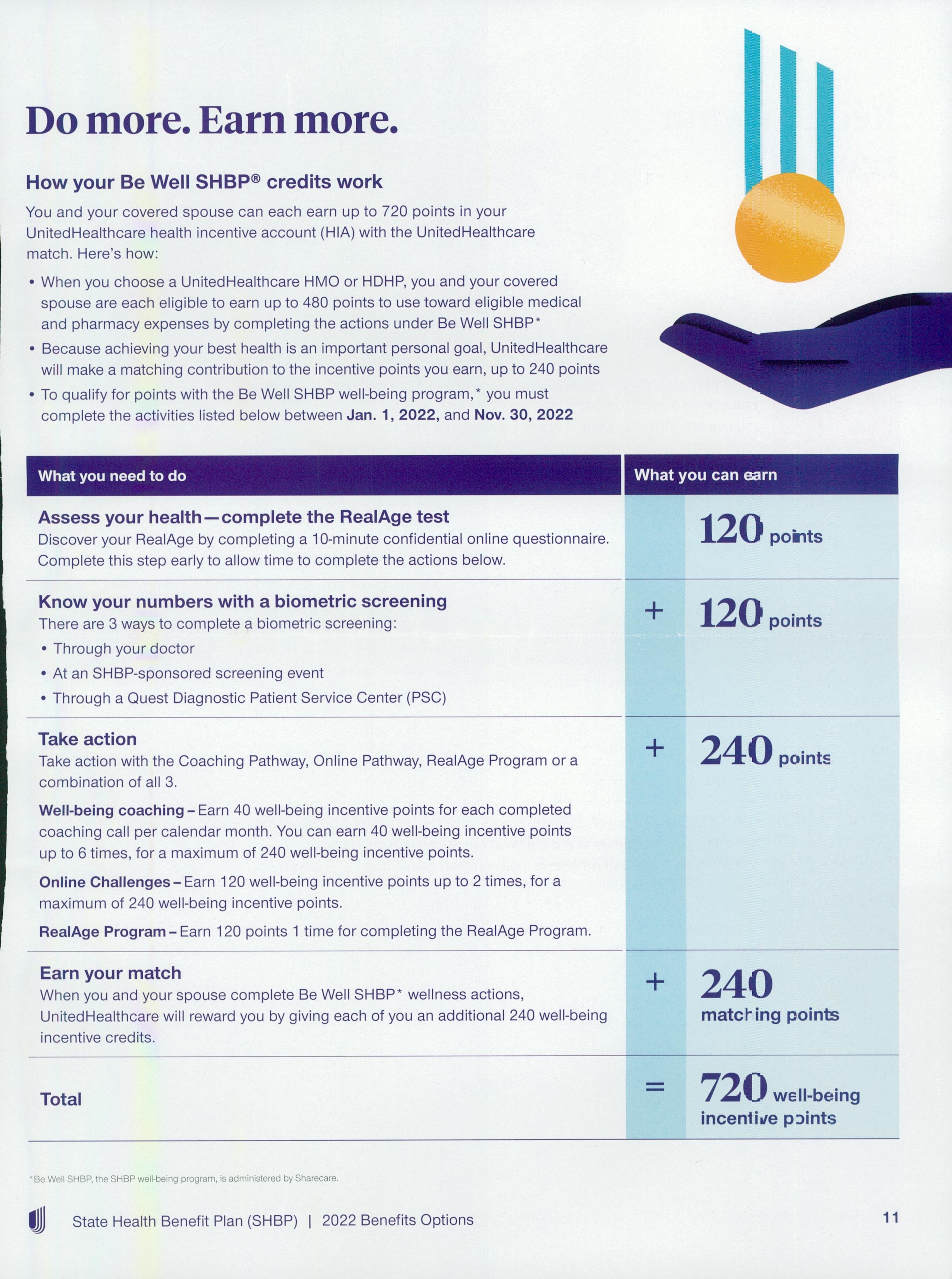

As a way to showcase that customers are in the driver’s seat when it comes to health plans, insurers relied on messages of freedom and control. Rewards were also often used to draw in prospects, offering gift cards to customers’ favorite retailers for making healthy decisions.

Credit: Comperemedia Direct

Credit: Comperemedia Direct

In addition to rewards and messages of freedom, many insurers touted five-star health plans as a reason to consider enrolling in coverage. While others put a spotlight on dual eligible benefits, like OTC allowances and transportation services.

Credit: Comperemedia Direct

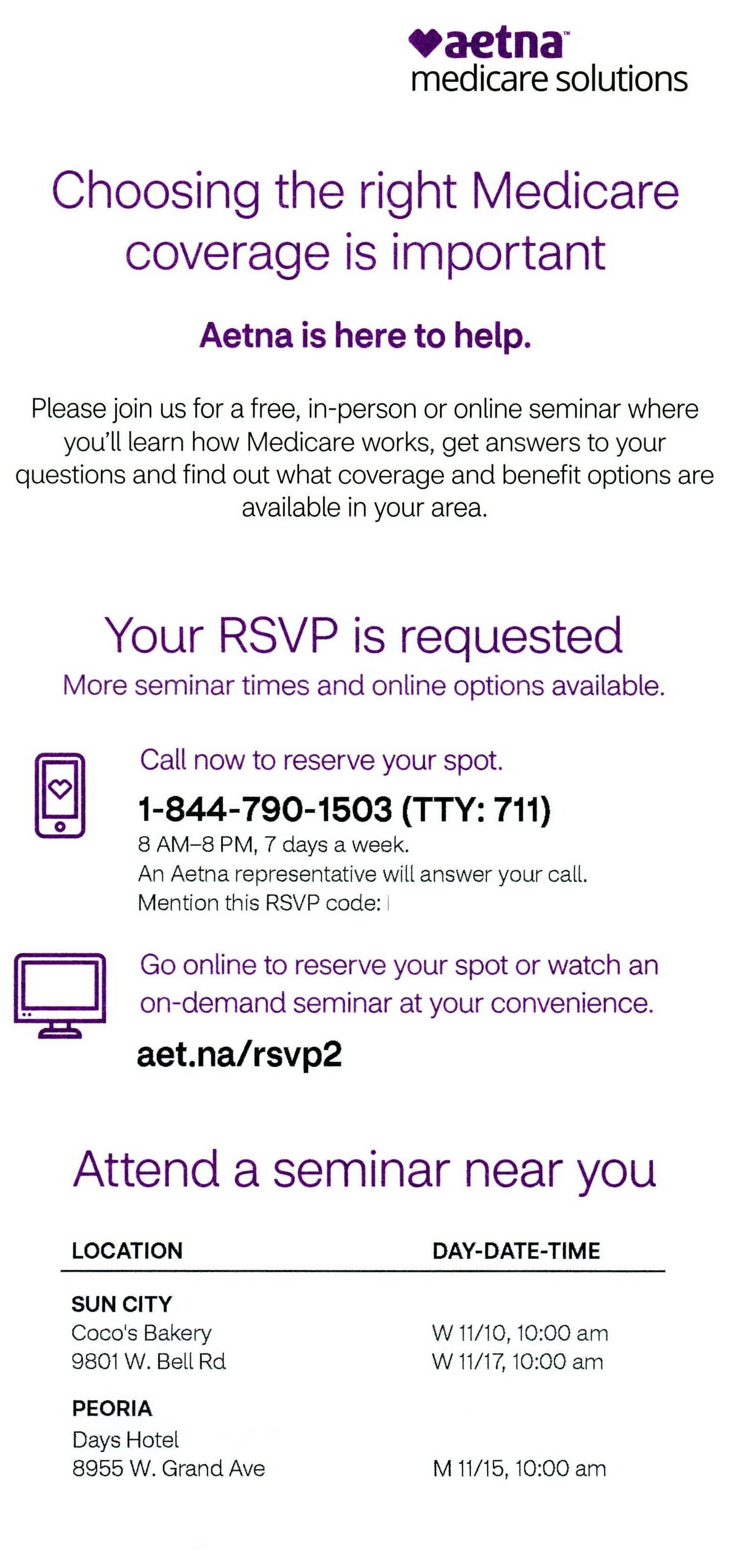

Insurers like Delta Dental and Kaiser Permanente introduced new plan options for its 2022 offerings, and in Medicare Advantage mailers, Aetna emphasized its $0 premium plans, which include dental benefits.

Credit: Comperemedia Direct

Meanwhile, many insurers used geo-targeting in direct mailers as a way to connect consumers with nearby Medicare resources.

Credit: Comperemedia Direct

In addition to those methods, UnitedHealthcare and BlueCross BlueShield of Nebraska encouraged consumers to get connected on Facebook.

According to a Mintel Report, 63% of consumers research health insurance options online. Concurrently, another Mintel Report also detailed that of Facebook users aged 55+, 88% say Facebook is one of the three social media platforms they visit most frequently.

To help stand out, Clover Health introduced a new mailer and tagline, “Why not?” The mailer highlighted several benefits that make its services standout, like $300 a year for OTC items, $1k for dental care, and the ability to see any doctor in or out of network.

Credit: Comperemedia Direct

Credit: Comperemedia Direct

Overall, health insurers found unique ways to stand out in the mailbox. Cigna used imagery to represent consumers’ journeys from a group plan to Medicare. BlueShield of California asked customers to choose the sticker that best fits their situation and transfer it to the attached reply form. CVS introduced its Medicare Support Center, offering a free, no-obligation review of customers’ Medicare coverages.

Industry News

Take a look at these recent partnerships, programs, and acquisitions.

United Health Care

- Enhanced oral health benefits in collaboration with quip.

- Announced the launch of NavigateNOW, a virtual-first health plan.

- UnitedHealthcare Vision members can now save 20% on Dell XPS laptops with Eyesafe blue light-blocking properties.

Humana

- Humana launched CenterWell Home Health.

- Humana Specialty Pharmacy announced two significant additions to its oncology therapies.

- Humana added Albertsons Companies pharmacies into its 2022 Medicare Part D plans.

Cigna

- Express Scripts provided coverage for at-home COVID-19 test kits.

- Announced the expansion of access to covered virtual care services through MDLIVE.

- Cigna expanded its Medicare Advantage Plans for the third consecutive year.

BlueCross BlueShield

- BCBSA and other BCBS companies partnered with Civica to increase access to affordable Insulin.

CVS & Aetna

- Developed an innovative, modern line of home health care products.

- Simplified access to at-home COVID-19 test kits.

- CVS Health and Uber Health partnered to advance health equity.

- CVS Health and Microsoft announced a new strategic alliance.

- CVS Pharmacy now offers Spoken Rx.

- Published several updates of its work to advance health equity.

- Announced that Aetna CVS Health individual and family plans are now available.

- Aetna’s 2022 Medicare plans feature more benefits and lower costs.

WellCare

- Offered innovative special supplemental benefits for the chronically ill during AEP.

Mutual of Omaha

- Offered dental providers quick access to members’ benefits and eligibility through new tools.

Comperemedia, a Mintel company, is an industry-leading competitive marketing intelligence agency. To find out more about Comperemedia’s products and services, please get in touch.

Maegan Maloney

Maegan Maloney