Data and Digital Printing

When Johannes Gutenberg invented the printing press in the mid 1400s, it was the single most important invention in the history of mankind, up until that point. The printing press enabled the dissemination of knowledge and information, helped kickstart the industrial revolution and began a process of self-education that continues to this day.

Until recently, the core technology of ink transfer via a plate onto a paper medium remained largely unchanged. Digital print technology pushed the envelope forward with printing technology that is now sufficiently cost- and quality-effective to challenge the offset incumbent. Most importantly, it enabled the pairing of customer behavioral and demographic data with digital technology. This change is poised to enable the next big shift in publishing; changing the way publishers produce, print and distribute books, magazines and catalogs.

Digital Printing Technology + Consumer Data Enable The Next Leap Forward

Despite the significant step forward in technology the printing press represented, it limited output to a static one-to-one relationship: The press was capable of outputting a single impression on the plate. Now, digital printing technology enables a “one-to-many” relationship, and publishers can take advantage of the technology to customize offerings.

Across book, magazine and catalog publishing, digital printing technology has impacted us in the following way:

On-demand Printing Drives Revenue Growth/Inventory Reduction for Book Publishers

By incorporating digital printing into their supply chain, publishers can respond to demand and, in some cases, reduce or even eliminate costly book inventory. Where profitability was once tied to publishers’ ability to look into their crystal balls and accurately forecast demand, publishers will be able to simply print on demand and sell direct to consumers, lowering the costs of warehouses, transport to/from storage facilities, and waste of unsold inventory.

By doing so, publishers increase the percentage of profit they make on a book by more than 60 percent from 8 percent of the retail value to 13 percent. One publisher reported saving more than $750,000 in waste costs per year and an additional $90,000 per year from transport costs.

Additionally, publishers can respond to spikes in demand and take advantage of media attention or awards to boost sales. Amy Cox Williams, director of content management at Ingram, describes one such scenario: “We had a publisher with a major award winner last year who put the title in GAP and, in 48 hours, we were able to ensure it continued to sell for the following weeks.”

Another example is Dover Publications, a book publisher who utilized LSC’s supply chain services to manage the production of over 10,000 titles. Using its technology, Dover Publications has been able to reduce base inventory by 40 percent since 2011. This was largely accomplished through the use of digital printing in the lifecycle management of a title. For example, printing a small “proof” quantity in the first run and then utilizing either digital or offset capabilities in subsequent runs allowed Dover to print only what it needed. This also has helped Dover Publications reduce base excess and obsolete inventory expense by over 300 percent.

By incorporating digital printing into their supply chain, publishers can respond to demand and, in some cases, reduce or even eliminate costly book inventory.

Personalization Enables Targeted Marketing for Catalogers

Consumers expect personalized interaction with brands: Research from Marketo shows nearly eight out of 10 (78 percent) of consumers will only engage with offers if they have been personalized to their previous engagements with the brand.

To meet this demand, catalogers are using rich data sets combined with digital printing technology to personalize offerings. Catalogers are using demographic information, purchase history, browsing history and more to personalize catalogs and ensure customers receive catalogs that highlight the products they are most interested in buying.

A recent InfoTrends study showed that a personalized approach pays dividends: Respondents who received personalized print materials exclusively experienced a response rate of around 6 percent and a conversion rate of over 16 percent. Compare this to the average 2 percent response rate more generic materials generate, and the power of personalization becomes abundantly clear.

Gone are the days of telephone book sized catalogs. Soon, shorter, more personal printed materials will become the norm. In fact, research firm Gartner predicts that by 2020, smart personalization engines used to recognize customer intent will enable online businesses to increase their profits by up to 15 percent.

Data and Digital Printing Promise Targeted Engagement for Magazine Publishers and Advertisers

Eighty-eight percent of marketers say using data to personalize the customer experience has a high impact on both ROI and engagement. Similar to catalogers who use purchase history, demographics and behavioral data to target purchasers, magazine publishers are working with advertisers to create inserts and targeted advertisements based on reader purchase history and demographic data. With studies showing brand recall to be 70 percent higher for print media than digital, and publishers now able to harness the response multiplier power of personalization in a print medium, magazine publishers are poised to make targeted print advertisement a key component of a well-rounded marketing program.

Going forward, publishers will be able to work with advertisers to hyper-target readers late in the buying funnel-based on content consumption behaviors. For example, a construction magazine publisher can work with a heavy equipment manufacturer to target advertisements to readers who are consuming content that indicates they are in the market for such a purchase.

Magazine publishers are also exploring leveraging digital behavioral data and digital printing technology to take personalization in the magazine industry to the next level: personalize the entire magazine. Using digital content consumption data, publishers will be able to determine the content that resonates most on a reader-by-reader basis. For example, based on digital consumption behavior, a law magazine can determine John is focused on personal injury law, while Sam is focused on criminal law, and personalize content in their respective print magazines. This enables deeper reader engagement and helps advertisers reach an audience most relevant to their product and services.

Digital Equipment Purchases Represent Opportunity For Publishers To Ask Printers For New Products And Services

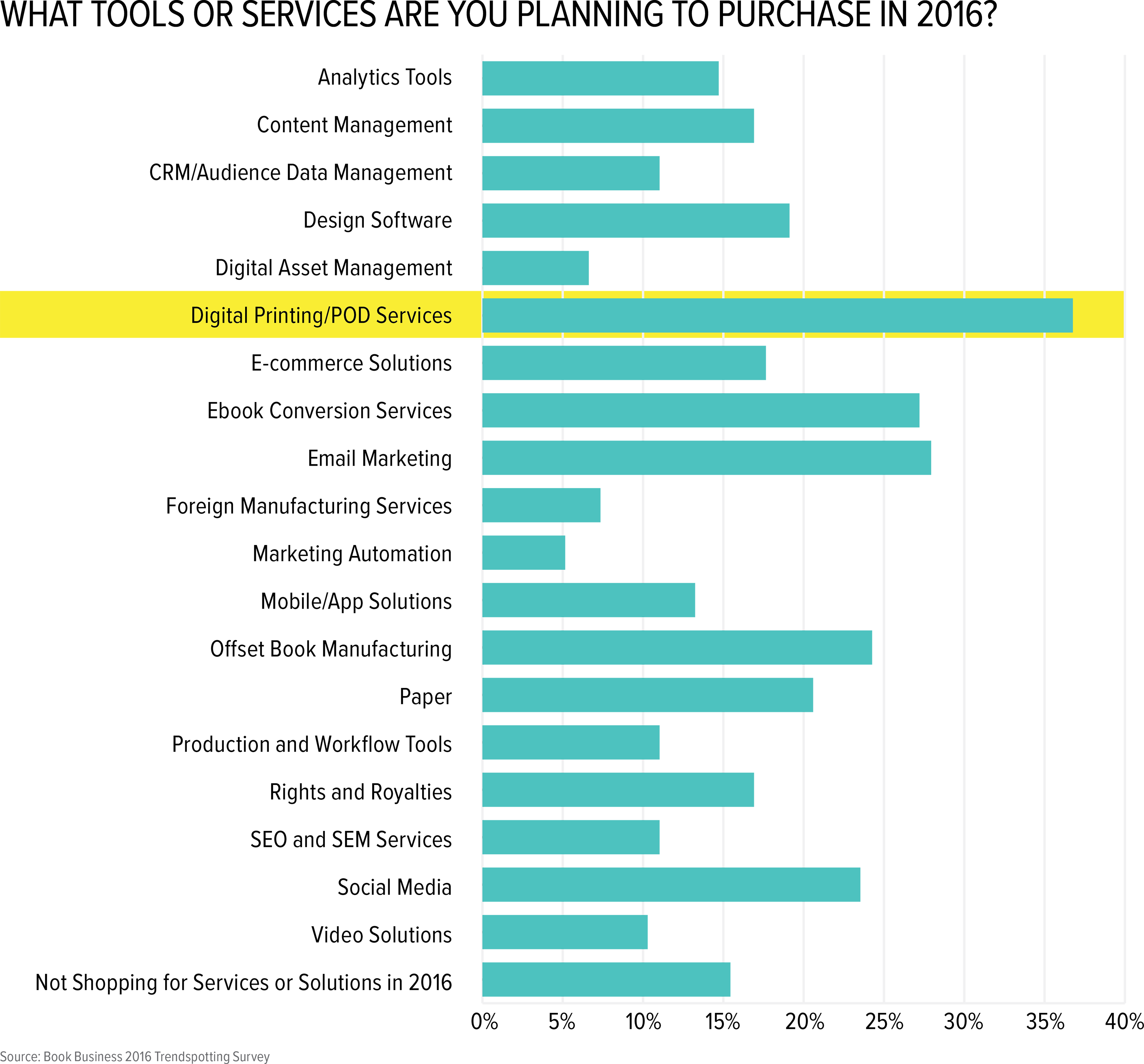

Given the benefits that digital printing equipment offers publishers, and the fact that it has been available for a number of years now, how are they embracing the technology? And what does that mean for publishers? A 2016 survey of book publishers showed digital printing/print on demand technology was the single biggest service book publishers planned to focus on in the coming year.

A new NAPCO Research/SGIA study of publication printers shows penetration of digital equipment has exceeded the halfway point. Fifty-one percent of publication printers now own a digital press and an additional 39 percent are planning to buy one in the next 12 months.

Of those who own a digital press, they are overwhelmingly happy with their investments — with 86 percent saying they are satisfied with their investment in digital equipment. More than half (52 percent) have been able to generate new business with the equipment and nearly one out of five (19 percent) have been able to increase personalization offerings to their customer base because of digital press technology.

This data — that suggests digital press adoption has exceeded the halfway point, digital press owners are overwhelmingly satisfied with their investments, and a non-trivial percentage have already figured out how to leverage customer data and technology to grow their businesses — suggests we are on the cusp of an industry shift that has the potential to change how publishers do business and enable new growth opportunities. By now, publishers should be asking their printers for personalization data and print services that will enable new growth opportunities, real cost savings and reduced overhead. With research firm Infotrends forecasting 16 percent CAGR for digital pages in the coming years, publishers must be prepared to capture their share of the pie by exploring cutting edge products and services.