Keeping customers engaged is top-of-mind for large banking brands.

That’s why big banks like U.S. Bank and Wells Fargo were product agnostic in their marketing.

While among top banking mailers, many opted to promote a specific product from their product suite in acquisition mailing, U.S. Bank and Wells Fargo’s top creatives were dedicated to checking overall. Both brands did not specify any of their products, but only encouraged potential customers to explore their checking options.

As brands continue to expand and add onto their product lines, such a strategy will become more commonplace: encouraging people to explore all their options so they can pick the best branded product for them.

Among customer communication, security was a popular topic that kept customers engaged. From contactless, to secure shopping, to avoiding fraud, many engagement mailers aimed at making customers feel safe and secure using their accounts, and especially their debit cards.

Online banking continues to become more commonplace, especially as many customers are holding on to early pandemic behaviors, like avoiding bank branches and spending more time online.

It was also found that cash bonuses go beyond acquisition mailing. Brands are utilizing cash bonuses for a wide range of strategies, especially to get customers more involved and engaged in their accounts.

For example, Capital One offered a $450 cash bonus to accountholders who added new money to their checking accounts, while Citizens Bank offered $25 to customers who enrolled in automatic monthly transfers from their Citizens checking account to a new savings account. Customers are cash-motivated, and brands are utilizing cash rewards to entice more customers to opt in to more engaging features of their accounts.

Consumer Banking Trends

Trends indicate that online and mobile banking activities have increased across the board, demonstrating a more permanent change in banking behavior. In this day and age, banks must continue to innovate and improve their online banking systems to cater to customers who are holding on to these mobile behaviors.

With apps, comes app security, that’s why brands are embracing app security by using the word “biometrics” in communications. In the past, the term “facial recognition” was often used, but some brands are embracing the more technological term. Ally and Discover both encouraged members to enroll in their biometric security in their apps, while Citibank confirmed enrollment and called it a “quick, seamless” way to enter to log in to the app.

Credit: Comperemedia Direct

Aside from security, thanks to online banking Citizens Bank and TD Bank encouraged accountholders to opt-in to automatic transfers to their savings. Citizens Bank offered a $25 bonus after customers opened a new One Deposit Savings account and set up automatic transfers for three months in a row from their Citizens Checking account. Meanwhile, TD Bank focused on the benefits of pre-authorized transfers like growing savings and included instructions of how to set up transfers.

Citizens Bank. | Credit: Comperemedia Direct

Discover sent simple, straight-to-the point emails to its accountholders and expanded more on membership rates for AAA members, regional banks and credit unions like Hoosier Hills Credit Union and Ponce Bank focused on their multiple CD options.

Banks also took different approaches to providing information about stimulus payments. For example, Huntington assured customers that their stimulus payment was safe, saying that if a customer had any pending fees from overdraft, the stimulus payment would not be touched.

Meanwhile, Navy Federal was more straightforward about payments, encouraging customers to utilize digital banking, while Capital One offered resources and common answers to stimulus questions to get ahead of the rollout.

Credit: Comperemedia Direct

However, recent COVID-19 mentions in mailers were often separate from the main takeaway of the communication, but different banks have different approaches. Wells Fargo includes its COVID-19 payment assistance reminder on every single statement alert email, while Huntington provided standard COVID-19 support materials via a link before getting into the main bulk of the email, welcoming the customer, and helping them get started.

Acquisition Overview

When it comes to direct mail, Citibank was a constant throughout the year, and both Wells Fargo and Chase ramped up direct mail volume beginning in August 2021. Chase Total Checking, Wells Fargo Checking, and Bank of America SafeBalance Banking all represented larger shares of voice in the latter half of 2021.

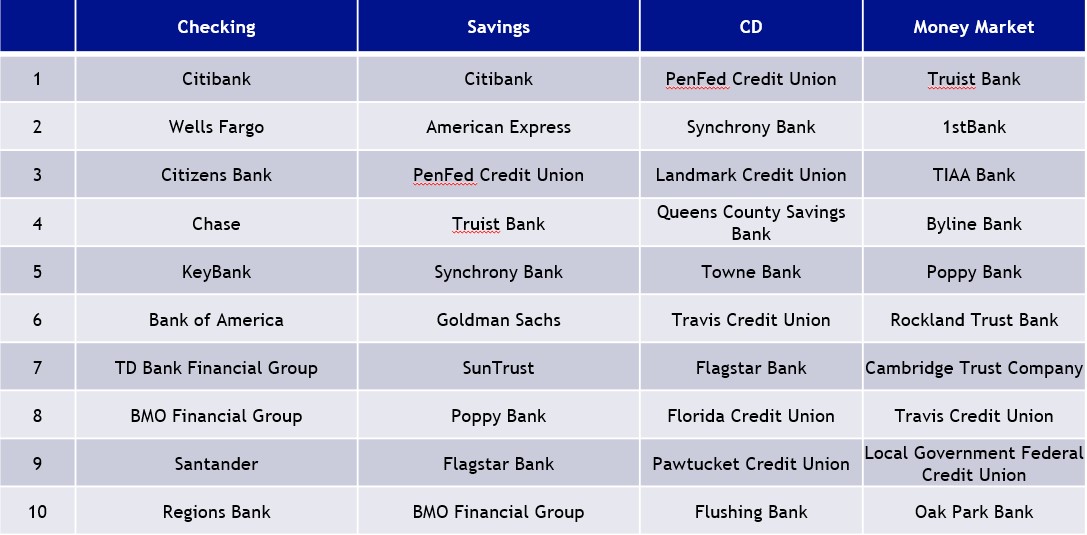

For banking products outside of checkings and savings, regional banks shined. In particular with CDs and Money Market products, where not one big bank cracked the top ten.

Top 10 Acquisition Direct Mailers by Banking Product

Source: Comperemedia.com. Top mailers determined by Nov. 2020-2021 yearly acquisition direct mail volume in each category. | Credit: Comperemedia Direct

Although acquisition email steadily decreased in Q1 2021, it picked up again mid-year due to Capital One’s return to email for its 360 Checking. While PayPal Cash Mastercard dropped out of email in late Q1 2021, Capital One 360 Checking ramped up piece count beginning in Q2. SoFi Money made significant appearances here and there in the second half of the year.

In terms of email marketing, The CD and Money Market landscape is a blue ocean within acquisition email, with only several issuers active for each product. In fact, checking and savings represent roughly 96% of acquisition direct mail volume. Across banking products, issuers aren’t taking part in win-back mailing.

Most banking brands focused on checking offers, while banks like Ally stayed out of acquisition direct mailing. However, some brands like U.S. Bank and Wells Fargo did not get product-specific in their top direct mail offers, instead promoting their checking overall.

Customer Communication Overview

Research indicates that Chase led customer communication efforts within the banking industry, followed by Navy Federal Credit Union.

In communications, some banks focused on becoming contactless. Debit card engagement mailers from traditional banks like Wells Fargo often pushed for contactless use. Wells Fargo called contactless “cleaner,” while U.S. Bank said that it didn’t require a signature and encouraged cardholders to request a new contactless version of their card. Capital One sent a full direct mailer spread on its debit card’s benefits, especially highlighting the convenience of contactless.

Credit: Comperemedia Direct

Meanwhile, USAA and TD Bank leveraged the security behind their debit cards, with TD Bank tying in the holiday shopping season.

Credit: Comperemedia Direct

Additionally, Bank of America dedicated an entire email explaining a new mobile app feature, while U.S. Bank sent an email every month to highlight different app features in its “Money Minute” series.

Bank of America’s email was effective in showcasing how to use its new in-app search bar, including images of not only the app, but popular searches from other accountholders as an example. Giving examples and using descriptive visuals to accompany new feature rollouts not only teaches accountholders how to do it, but simultaneously demonstrates the importance of its use.

U.S. Bank’s informative strategy via continuous and expected newsletters allows engaged accountholders to keep up with new rollouts.

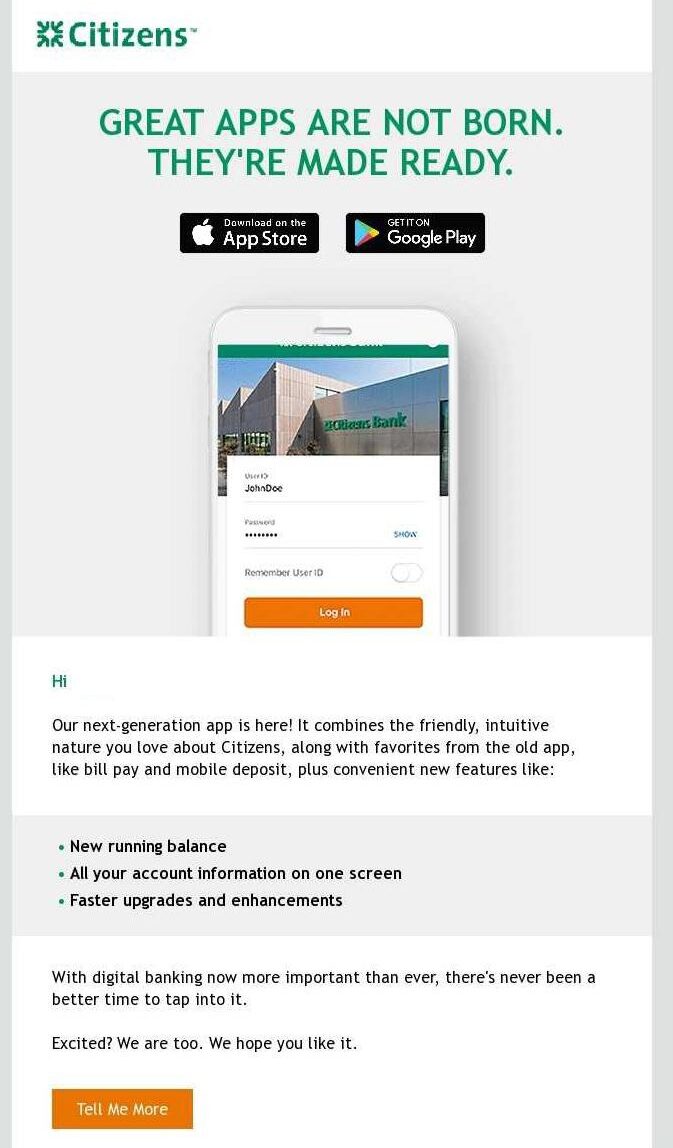

For Citizens Bank and Regions Bank, they used app update communications as an excuse to promote their app features. Citizens Bank made what could have been standard and formal update notification more exciting, rolling out its “new generation app” while listing its new convenient features like new running balance, account information on one screen, and fast upgrades and enhancements.

Credit: Comperemedia Direct

Regions Bank, while not as celebratory, utilized a similar strategy by encouraging accountholders to download the newly updated app, while also promoting the app’s features.

Huntington sent numerous pleas for a customer to opt into all features of its online banking, including a checklist to keep track. Several months later, the bank began cross-selling other products like Money Market and Voice credit card.

Brands like Capital One prompted accountholders to add more money to their accounts via partnerships and offering cash bonuses. In a strategy often used in welcome bonuses, Capital One offered up to $450 for accountholders to add new money and maintain it for a specified amount of time. It followed up on this communication a month later. The bank also promoted its partnership with CVS and encouraged members to add cash to their 360 Checking account there.

Noteworthy Campaigns

Bank of America

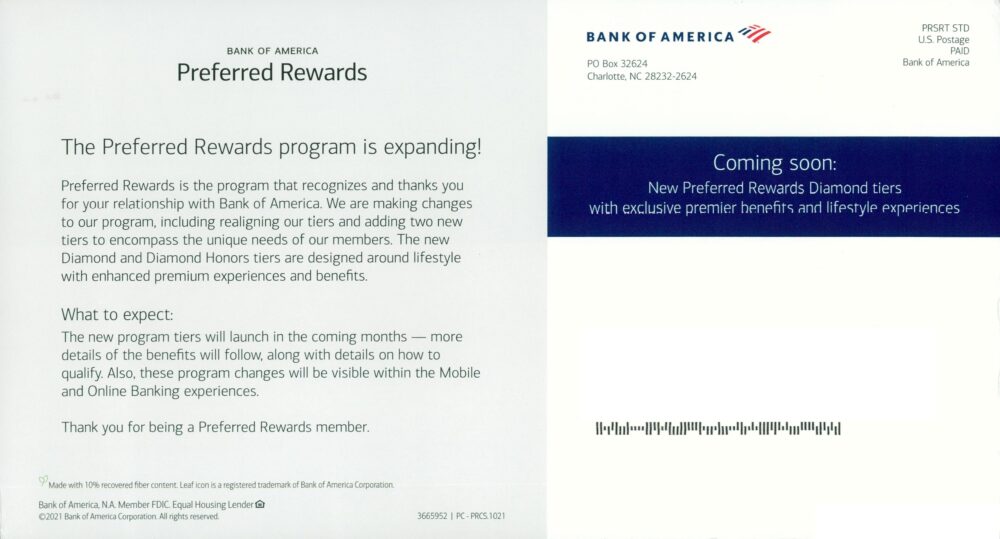

Bank of America teased its revamped Preferred Rewards program via direct mail. The bank sent engagement campaigns to current Preferred Rewards members, informing them that new tiers and rewards would be launched in the coming months.

Though Bank of America sent the communication as a direct mailer, it also said that “these program changes will be visible within the Mobile and Online Banking experiences.” Bank of America is taking a cross-channel approach to its program’s new rollout, so that communications and new rewards are clear to members.

Credit: Comperemedia Direct

Credit: Comperemedia Direct

Chase

Chase targeted Amazon cardholders specifically with a special offer after opening a Chase Total Checking account. Chase offered Amazon cardholders $225 after opening a Chase Total Checking and then setting up direct deposit within 90 days. While this is a common cross-sell strategy among banks trying to make the most of their cardholder base, it’s often done among bank-branded cards.

Though Chase is the issuer for its Amazon credit card, the main focus of the brand is on Amazon itself and many cardholders that open such a card are there not for Chase, but to get the Amazon-specific rewards. As many more co-branded credit cards continue to pop-up, especially among retailers, it will become more common for credit card issuers like Chase to take advantage of this growing cardbase and bringing these co-branded loyalists like those for Amazon over to more of Chase’s ecosystem.

Citibank

Citibank rolled out a new referral program for Citigold customers, offering up to $4,000 for its Member-Get-Member program. While referrals are more commonplace in the credit card sector, they’re continuously gaining more steam in banking, too.

Citibank’s strategy is similar to that of a credit card referral, encouraging customers to share a unique referral link with friends and family. However, the payoff is a bit bigger than credit cards: Citibank is allowing Citigold customers to make up to 20 referrals, $200 each person equating to $4,000 total.

Huntington

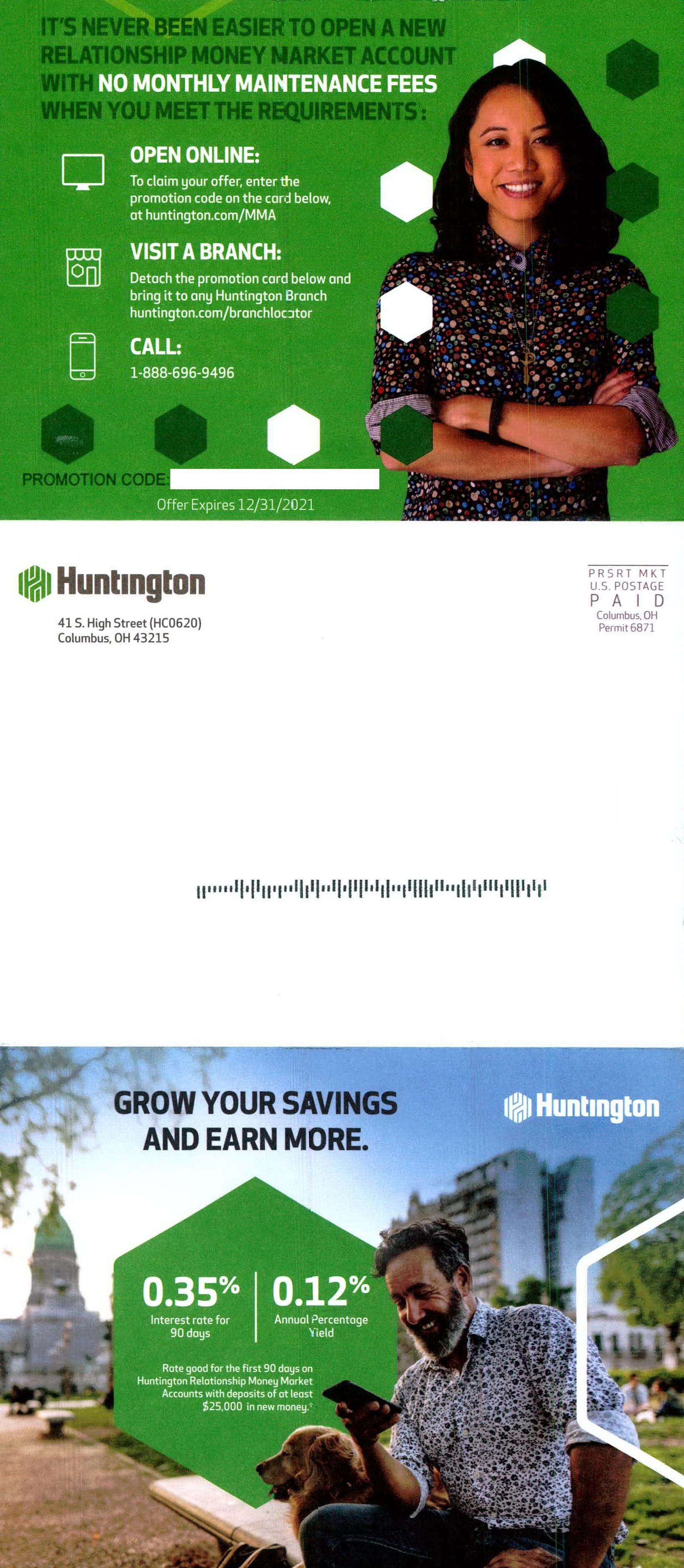

Huntington returned to acquisition direct mail for the first time in a year and a half with revamped creatives promoting its Relationship Money Market account. The vast majority of Huntington’s acquisition direct mail in the last three years has been dedicated to its Money Market product, though it was absent since summer 2020 before returning with a refreshed campaign in November 2021.

The bank added imagery of people and focused more on the lack of monthly maintenance fees, as well as its other features like 24 Hour Grace and Return Fee Relief. In its acquisition mailing, Huntington is trying to sell its overall banking ecosystem alongside its individual products.

Credit: Comperemedia Direct

Overall Takeaway

While checking and savings products continue to reign supreme, new things are happening in the banking sector, such as cash incentives as a way to entice accountholders to check out new features. As banks continue to innovate and improve their online and mobile banking features, offers like those from Citizens Bank and others offering cash to try these features will become more popular.

Smaller, regional banks, which may not be able to offer such high amounts like the bigger banks, still have an advantage in one area. Smaller banks are capturing the vast majority of share of voice in less popular banking products like CDs and Money Market accounts. For smaller banks looking to boost voice, such products aren’t often promoted, and represent a blue ocean for many banks looking to get into the direct mail or email space.

Comperemedia, a Mintel company, is an industry-leading competitive marketing intelligence agency. To find out more about Comperemedia’s products and services, please get in touch.

Emily Kapp

Emily Kapp