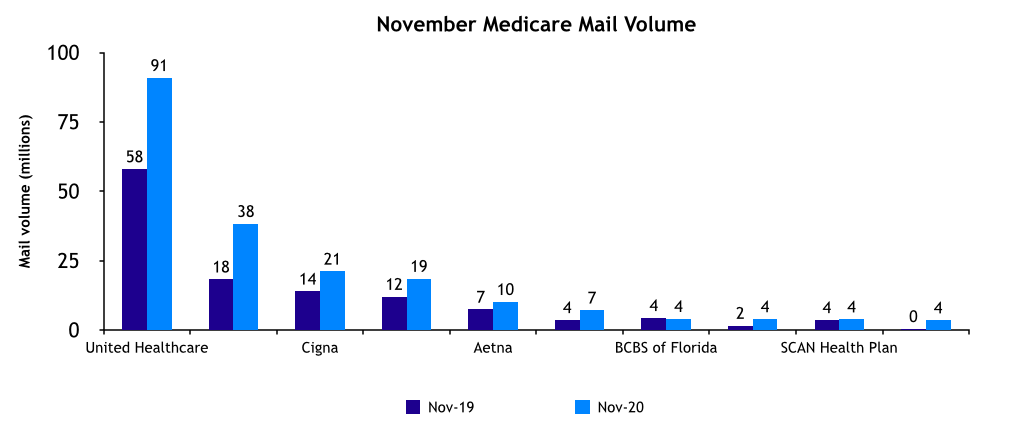

Mail volume increased substantially from November 2019 to November 2020 and insurers continued to promote low costs, expansive health networks, and comprehensive coverage ― with some offering tempting incentives along the way.

Medicare mail volume increased 43% Y/Y due to significant volume bumps from four of the top 10 mailers, United Healthcare (57%), Humana (109%), Cigna (51%), and Anthem (54%).

Mintel Comperemedia; Includes Medicare Advantage, PDP, Supplement, dual-eligible, and general Medicare offers. | Credit: Comperemedia Direct

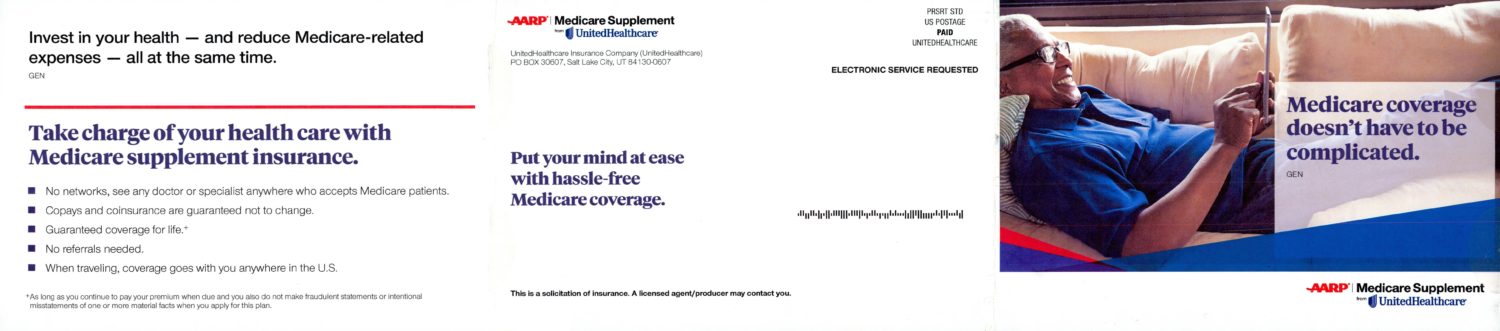

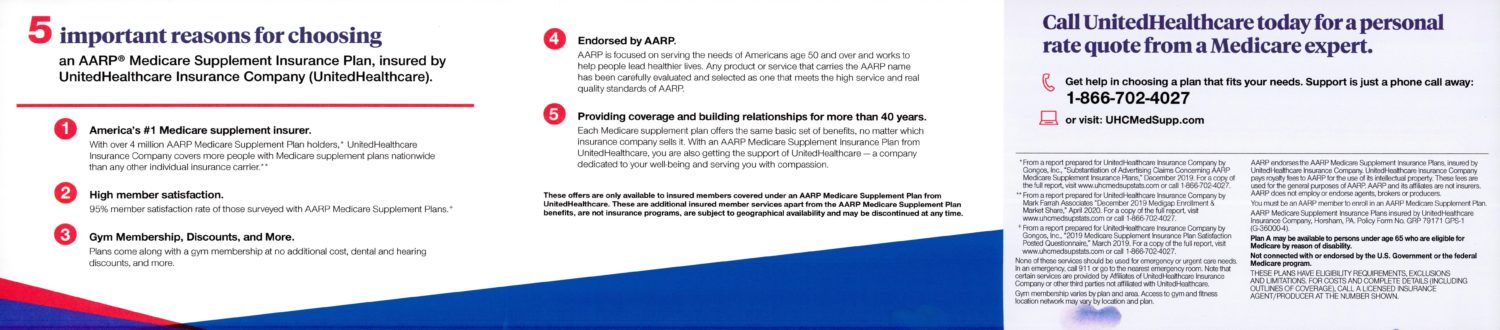

Top mailers United Healthcare and Humana positioned themselves as “no-brainer” selections.

UHC leveraged its reputation to promise simplified Medicare coverage in its campaign.

Credit: Comperemedia Direct

Credit: Comperemedia Direct

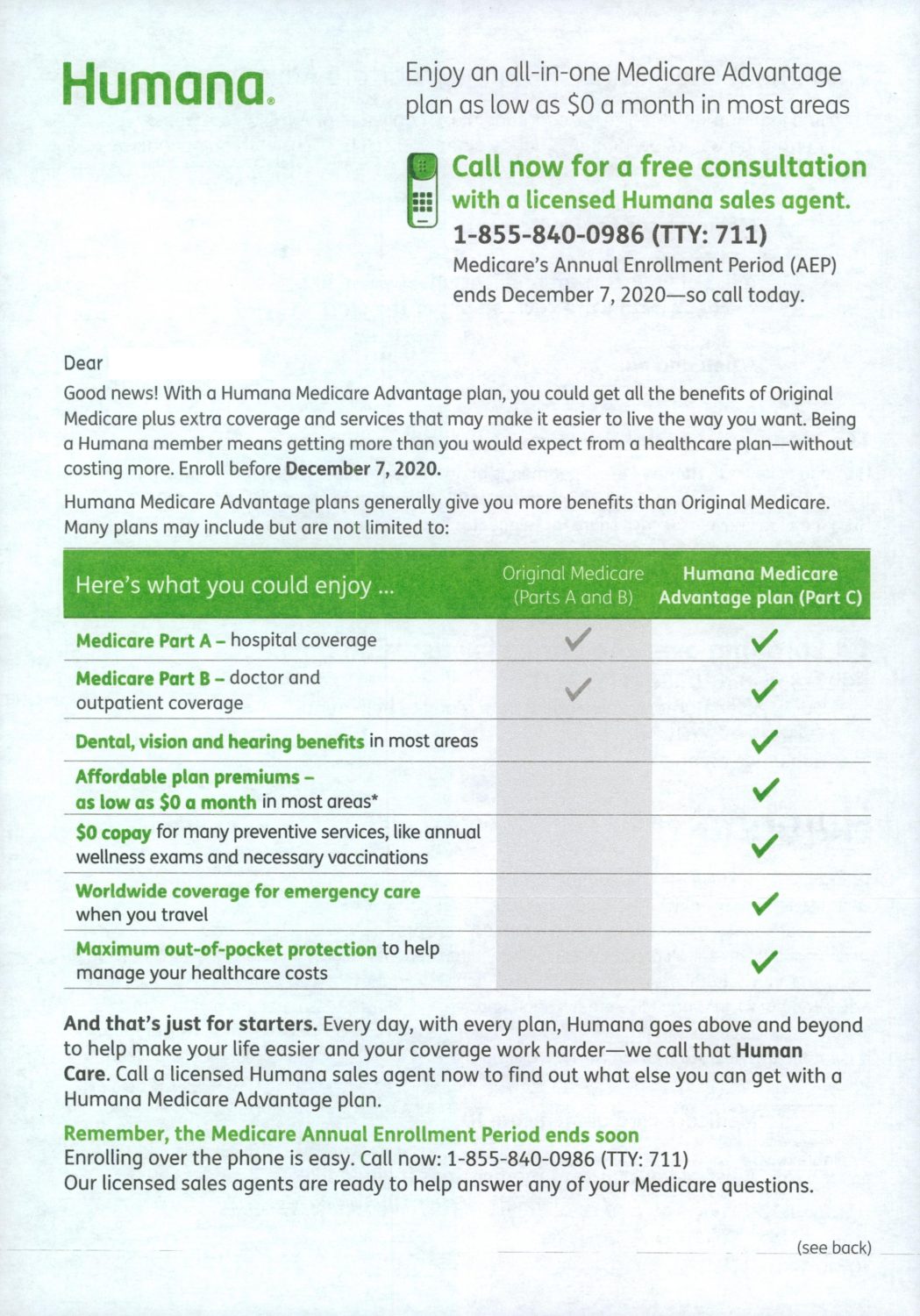

Humana used its communication to pit its Advantage plan against Original Medicare.

Credit: Comperemedia Direct

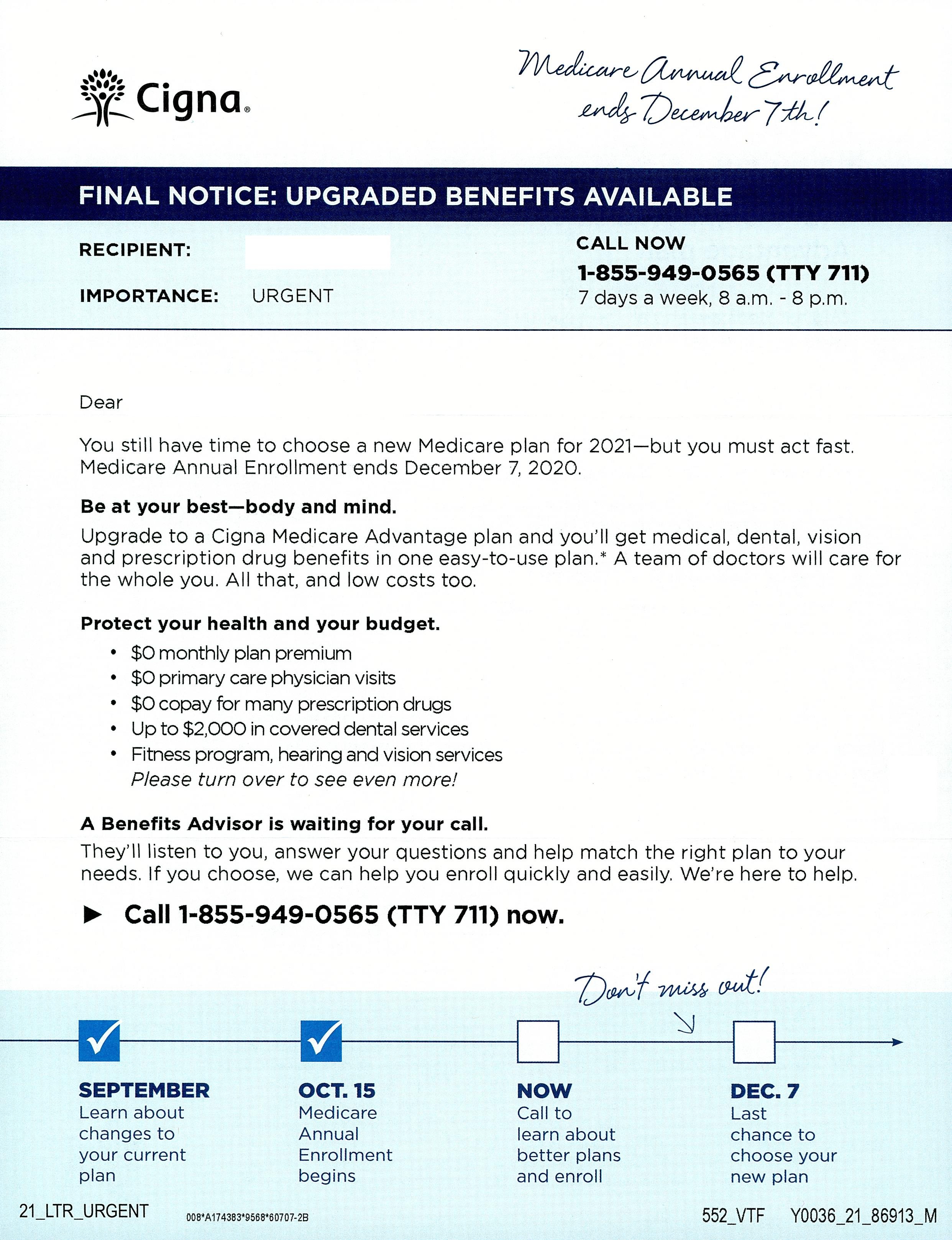

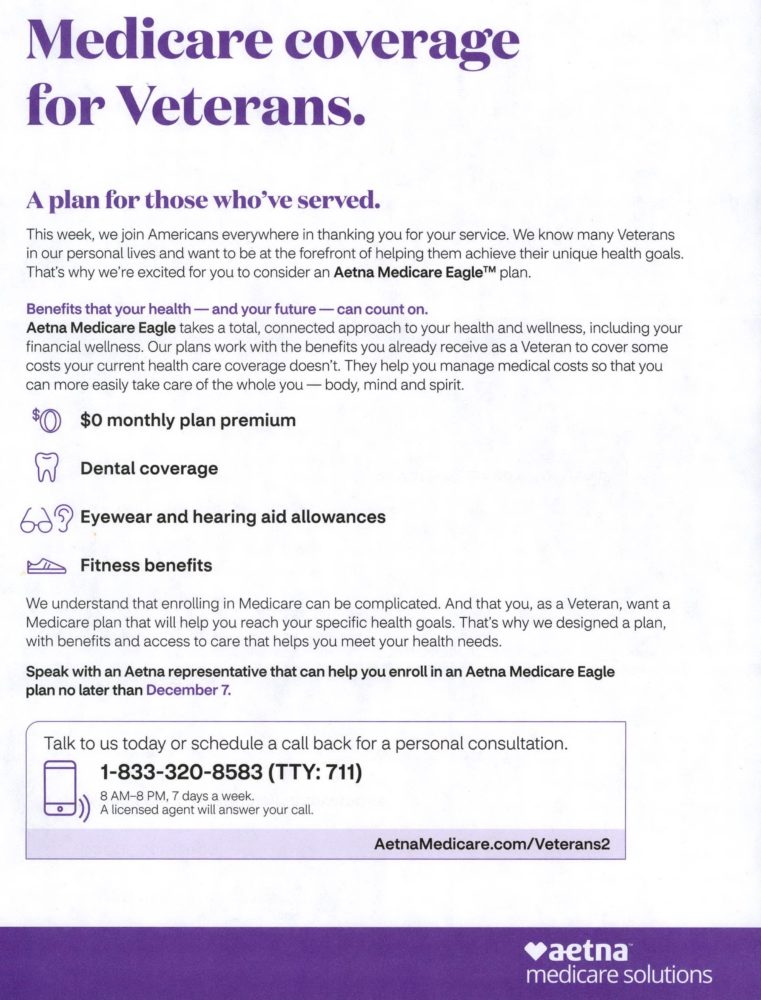

Cigna and Aetna both touted $0 monthly plan premiums as key advantages of their respective coverages.

Cigna encouraged members to be at their best.

Credit: Comperemedia Direct

Aetna, on the other hand, catered its Medicare coverage to Veterans.

Credit: Comperemedia Direct

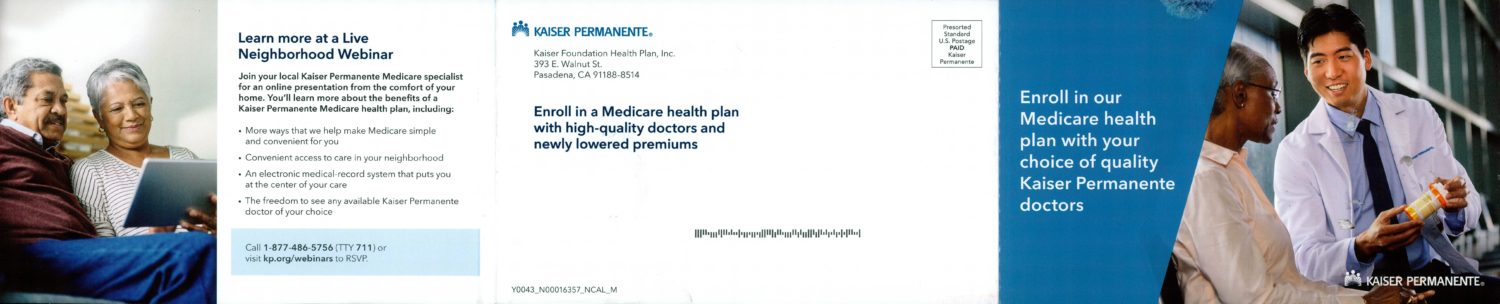

Anthem and Kaiser Permanente continued to stick to the basics: pricing, network, and comprehensive coverage.

Credit: Comperemedia Direct

Credit: Comperemedia Direct

Anthem introduced a $280 per year incentive toward health care items at Walmart.

Credit: Comperemedia Direct

Similar to previous years, insurers highlighted consistent value propositions that provide the utmost value to Medicare shoppers. With the messaging starting to blend, marketers will need to step it up and focus efforts on new and existing customer communications. According to JD Power’s 2020 Medicare Advantage Study, “Clear, helpful, proactive communication provided by Medicare Advantage plans to members is a key driver of overall customer satisfaction and consumer perception of trust.” That same study found that insurers are missing the mark with communication, which was amplified due to the pandemic. “Consumers are 3.3 times more likely to receive a helpful communication from their bank than from their health plan, based on additional data from current J.D. Power financial industry studies.”

Insurers will need to prioritize helping members fully understand their plan details, especially as the effects of COVID-19 continue, and in return, could secure long-term loyalty. Brands should be outlining plans for regular check-ins with customers and strengthening strategies to keep preventative care top-of-mind.

Comperemedia, a Mintel company, is an industry-leading competitive marketing intelligence agency. To find out more about Comperemedia’s products and services, please get in touch.

Nicole Bond

Nicole Bond