To enhance the banking experience, banks encouraged people to use mobile apps and digital tools.

Laying the foundation

Brands framed apps as the entry point to the entire banking experience. This way, they could establish a method of engagement — and build loyalty — from the beginning of the customer relationship.

Value Beyond a Touchpoint

Financial services institutions garnered ever-so-slightly higher read rates for app-related subject lines — 29% for subject lines mentioning “app,” “apps,” or “download” versus 27% for all other financial services subject lines — suggesting apps aren’t quite the selling point they may want.

In mailers, Bank of America highlighted the app’s facilitation of mobile check deposits, transfers, and customer service. These are all things people could do in person or on the phone before mobile apps. Including customer service and account alerts in the list of app capabilities could help reassure customers that they would be gaining, not losing, a degree of personalization with digital banking.

Credit: Comperemedia Direct

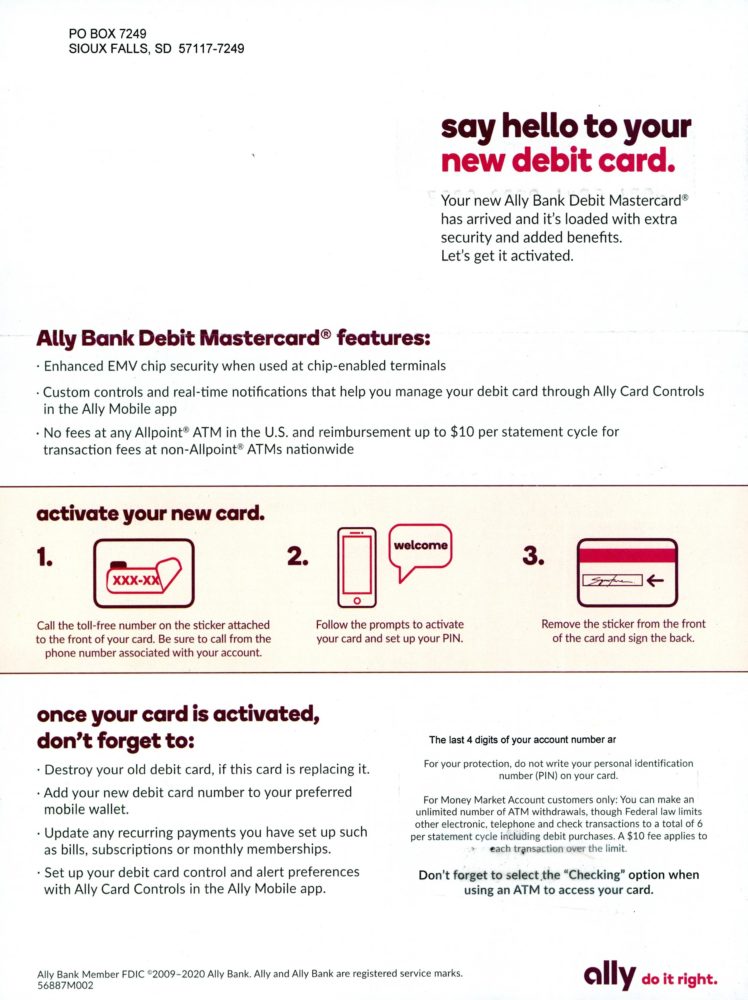

Ally set the tone for the customer relationship in a debit card welcome kit by tying the card to the mobile app, where the majority of interactions can take place. Ally missed an opportunity to engage customers with the app from the get-go by allowing them to activate their cards there, instead of on the phone.

Credit: Comperemedia Direct

It’s notable that Ally directed cardholders to the app, rather than its website, to access card controls; the online-only bank aimed to stay in touch constantly by targeting the device people have with them all the time, not their desktop computers.

Credit: Comperemedia Direct

By depositing the money into customers’ PayPal accounts — which they could access in the app — PayPal demonstrated the literal value of its app. The company included not one but two buttons to get the app, which it made out to be both useful and fun. Pointing out little bonuses (like the ability to use emojis) plus more crucial features (like security) made the app feel like an improvement on the old way of doing things.

In an email encouraging customers to use its mobile app, Citi highlighted typical features — checking balances, setting alerts, and so on. But the company ended the email with a unique point, saying, “The Citi Mobile App. Designed for you to spend less time on it.” In other words, the bank wanted the app to be so easy to use, and so advanced, that it’s efficient and saves people time.

U.S. Bank positioned itself as a benevolent helper aware of social and public-health context, putting financial mastery alongside “safe, contactless payments.” In a paid Facebook creative, the image of toilet paper in a grocery bag made it clear that “safe” was a reference to the pandemic — a reference that was lost in direct mail, where “safe” sounded more like “secure.”

Financial services brands tried to make pandemic banking a little easier, emphasizing the role their mobile apps play. For example, in a paid Facebook ad, Wells Fargo, turned to typical COVID-marketing language, saying, “In times like these,” customers can use Wells Fargo’s mobile app (and online banking).

Like Wells Fargo, U.S. Bank spoke in expected language about the pandemic and used it as a reason to introduce people to its app.

Building a Better Mousetrap

There’s more to digital banking than an app that can show customers their account balances. Digital tools, both in the app and beyond, can reinforce a brand’s identity by complementing, improving upon, and even adding to specific parts of money management.

A focus on all things digital — beyond straightforward banking tasks — allowed banks to improve upon specific parts of banking and provide tools traditional banking can’t.

In multiple mailers, Capital One framed its app as supportive and “powerful,” giving customers tools they wouldn’t otherwise have.

Credit: Comperemedia Direct

The mailers made Eno out to be an advanced tool doing things people can’t, such as creating virtual card numbers.

To show how they were making things easy for customers, brands highlighted the advantages of digital payments.

TD Bank alluded to the pandemic in encouraging linking a debit card to Apple Pay in a paid Facebook ad. This was a way to show how its products could complement existing digital tools, and vice-versa.

In Canada, banks framed digital tools as a means to achieve goals. TD and CIBC framed their tools as the key to success, with TD offering goal-oriented investing app GoalAssist and CIBC promoting GoalPlanner for overall financial wellness.

Banks promoted Zelle — which served not only its payment purpose but also as an representative example of the usefulness of their apps. Outside of the fine print, M&T Bank was one of the only companies to promote Zelle in direct mail — the majority of mentions were online — using it as an example of “bank[ing] beyond the branch.”

Credit: Comperemedia Direct

Adding the Finishing Touches

In acquisition creatives, traditional banks set out to convince customers that their apps would be an important facet of the customer relationship, while fintechs took it as a given that the entire relationship would be based in app and online. But fintechs didn’t lose sight of the tangible, using physical cards to embody their value propositions while simultaneously imbuing those cards with an aura of the digital.

Venmo and Apple, to name just two brands with digital-first approaches, leaned into imagery of their physical credit cards. Meanwhile, both brands continued to promote digital payments. But because the brands used the cards to only represent the idea of spending, not the actual mode of paying, they were able to maintain their digital appeal.

For traditional players, this approach could be tough to pull off, since they’re still associated in part with brick-and-mortar branches and ATMs. But they could imbue their cards with more of a digital feel by tying rewards — and the ability to adjust those rewards, especially for new custom rewards cards—to their apps.

Credit: Comperemedia Direct

Credit: Comperemedia Direct

Wealthfront and Betterment promoted automated investing. Both automated investing and apps reflect the digitization of banking that fintechs, including Wealthfront and Betterment, are driving. In this sense, the two companies used apps to reinforce their overall value proposition.

What’s more, by including app images in these creatives, the companies could promote two features in a single creative and give automated investing the aura of convenience that apps inherently have.

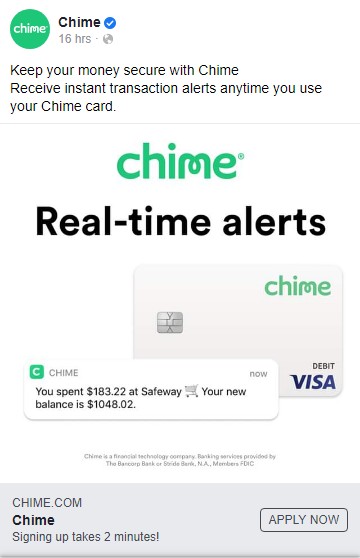

Digital-first Chime touted the same kinds of digital-only features traditional banks also highlighted — all without mentioning the word “app.” Notably, Chime didn’t need to say that transaction alerts and card blocks were available through its app. Instead, it let its brand identity and screenshots — rather than images of phones — speak for themselves.

Credit: Comperemedia Direct

Using Apps to Augment the Banking Experience

For the most part, people like banking apps, especially since the pandemic limited in-person activities. According to the Mintel report The Banking Experience – US – March 2021, 31% of respondents use banking apps more often because of the pandemic. But there are still reasons to visit bank branches — 49% of respondents visit bank branches to use the ATM. That means brands have an opportunity to promote various touchpoints, not just digital ones. And when they do promote digital engagement, they can show how it complements the overall customer experience. That way, as they continually upgrade digital tools to keep them exciting, interesting, and useful, brands can make the overall relationship feel exciting, interesting, and useful too.

Comperemedia, a Mintel company, is an industry-leading competitive marketing intelligence agency. To find out more about Comperemedia’s products.

Rachel Arndt

Rachel Arndt