Most people don’t trust the health insurance industry, nor do they see health insurers as partners. Health insurers can start the relationship off right by being transparent from the get-go so people not only understand their benefits but trust where they’re coming from. To boost interaction with members, health insurers promoted digital touchpoints and personal health management tools such as online tools, virtual care, and resources for managing their own health.

Go Online

Some health insurers have guided members to their websites and apps to see details about their plans, get ID cards, find doctors, and more. This kind of digital access to members’ plans is commonplace — with actual usage less so. To get people to notice digital touchpoints, insurers put invitations to use them front and center.

For example, UnitedHealthcare encouraged members to use online tools to learn about their plans.

Credit: Comperemedia Direct

Humana had a similar approach to UnitedHealthcare. By putting the messages in the first place people see, both companies reinforced the centrality of digital access and used it as a framing device for the information within.

Credit: Comperemedia Direct

In a mailed “personalized wellness plan,” Highmark led by advising members to visit its website and use its app.

Credit: Comperemedia Direct

Virtual Care

The push for virtual care was among the most common digital health messages from insurers, with many companies encouraging members to use telehealth services. Getting people to seek virtual care at times when they might forgo care altogether can help lower costs for insurers — and keep members from falling behind on preventative care.

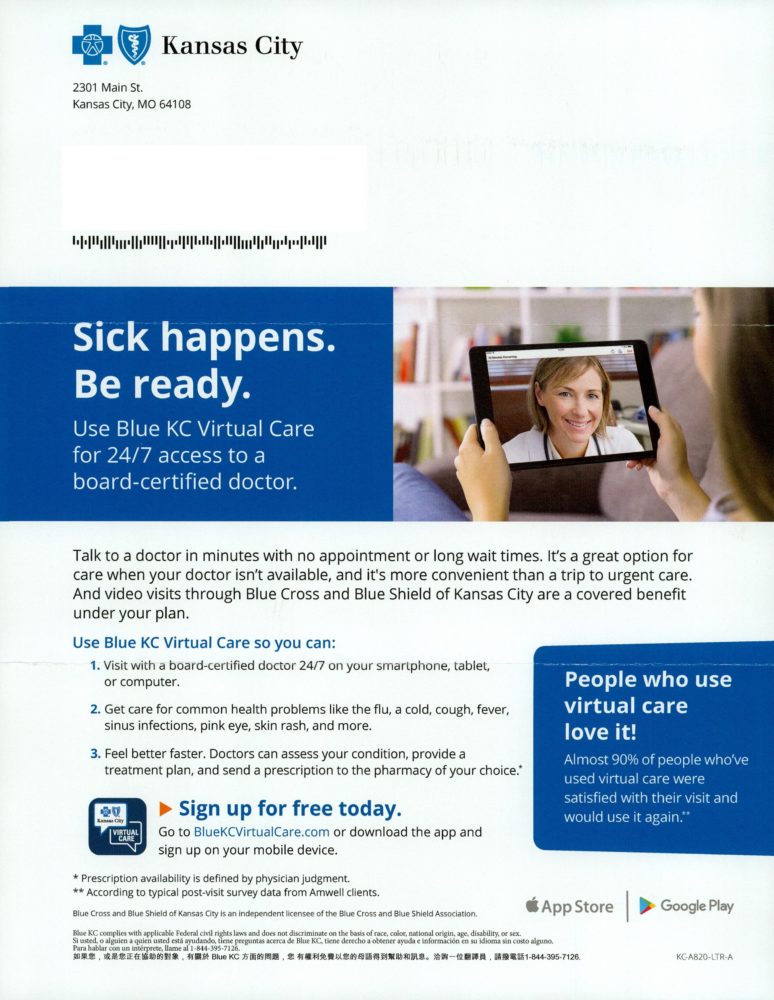

BlueCross BlueShield of Kansas City mailed out information about virtual visits, encouraging people to access them either online or through apps.

Credit: Comperemedia Direct

UnitedHealthcare used a similar approach and tied a specific use case to its apps and websites to increase the odds that members would find other uses for the apps too.

Both BlueCross BlueShield of Kansas City and UnitedHealthcare cited convenience as a reason to go virtual.

In an acquisition effort on Facebook, UnitedHealthcare promoted virtual visits and focused on speedy access to health care.

Credit: Comperemedia Direct

Also on Facebook, Cigna, focused on convenience and confidentiality in a promotion for virtual mental healthcare.

Credit: Comperemedia Direct

Digital-first insurer Oscar used imagery — and its reputation — to imply virtual visits without outright saying it. Virtual access is baked into Oscar’s brand, so the insurer didn’t need to spell out the benefits of digital visits like other insurers did.

Credit: Comperemedia Direct

Manage Your Own Health

Health insurers encouraged members to manage their own health with apps, digital coaching, and fitness programs. By connecting to tools people already use, companies cut down barriers to entry. And by partnering with consumer tech brands, they borrowed an air of the digital.

Some companies relied on partnerships to lend them a digital-first vibe and give members attractive ways to manage their own health.

Kaiser Permanente provided access to mindfulness app Calm to its members, via Instagram.

Credit: Instagram

Empire BlueCross BlueShield, on the other hand, touted its Alexa skill as a way to get personal plan details.

Credit: Comperemedia Direct

To promote Wellvolution, Blue Shield of California used lifestyle imagery on Facebook to make goals feel personal and relatable.

Credit: Comperemedia Direct

Insurers frequently cite healthy habits in their digital health marketing, and Mutual of Omaha was no exception. By emphasizing that its program Mutually Well — its wellness tracker for members over 50 — fits into “your daily routine,” the company suggested that Mutually Well interactions should also be daily, with the hope of increasing touchpoints — and getting more data from members.

Credit: Comperemedia Direct

Aetna and UnitedHealthcare partnered with Apple to put the tech giant’s familiar fitness tools in members’ hands.

With its Attain program, Aetna offers rewards to members for hitting health and wellness goals. One reward is an Apple Watch, which then feeds data into the program, adding more data to the health data Aetna already includes.

Credit: Comperemedia Direct

After Apple Fitness+ launched in December 2020, UnitedHealthcare announced that members of Motion, its activity-tracking program, would get five months of the fitness service for free.

Streamlining Health

People don’t tend to use health apps for insurance purposes; instead, they’re using them for fitness tracking. Health insurers might have better luck with adoption if they promote the fitness-tracking capabilities their tools have. They could highlight how having fitness information and health information in a single place can result in greater insights for the user.

Uniting all of a person’s health, exercise, and wellness information in a single place can be tough, especially given privacy regulations. Use of insurance apps is currently low, so insurers might have better luck connecting with people through the tools they already use (or are tempted to start using).

Comperemedia, a Mintel company, is an industry-leading competitive marketing intelligence agency. To find out more about Comperemedia’s products and services, please get in touch.

Rachel Arndt

Rachel Arndt