Annuity direct mailers are focused on offering transparency, security, and confidence in communications to customers and agents alike.

That is why they urge their customers to move confidently toward a prosperous retirement.

To achieve this, brands encouraged customers to take advantage of an annuity to protect their income in retirement. Mailers often included eye-catching facts, like “bills don’t retire” and “18 years is the average length of retirement funds,” as ways to urge customers to invest.

Brands then paired that messaging with comprehensive information about product offerings to educate customers and help them make confident decisions about their financial futures. Brands also equipped their agents with educational resources to leverage so that their clients were able to stay abreast of topics like market volatility.

Brands also made it clear that annuities are not a one-size-fits-all solution. In Fact, in communications to agents, many brands harped on the fact that a one-size-fits-all approach would lead to missed opportunities for their clients.

They emphasized that no path to retirement is the same and each client has very unique goals, therefore it was the agents’ job to offer simple and transparent information about annuity options. Through this transparent and easy-to-understand approach, agents would be able to solidify relationships and build trust with clients while offering them a clearer journey towards retirement.

Consumer-Facing Communications

PNC positioned an annuity as a complement to customers’ existing retirement plans, touting added confidence and growth opportunities. Saying things to customers like, “Whether you’re about to retire or still in the planning stage, you may want to consider an annuity as a way to complement your retirement strategy. Annuities are designed to help meet retirement and other long-term goals with a steady stream of income.”

Credit: Comperemedia Direct

On the other hand, AAA Life continued to leverage a longstanding annuity mailer which spotlighted the average length of a retirement fund, urging customers to get in touch with an agent. Its mailers also elaborated on the different types of annuities to help customers consider which option was right for them.

Credit: Comperemedia Direct

Similar to AAA Life, USAA also relied on a well-established annuity mailer which positioned its income annuity as a solution to protect customers’ income for life.

Credit: Comperemedia Direct

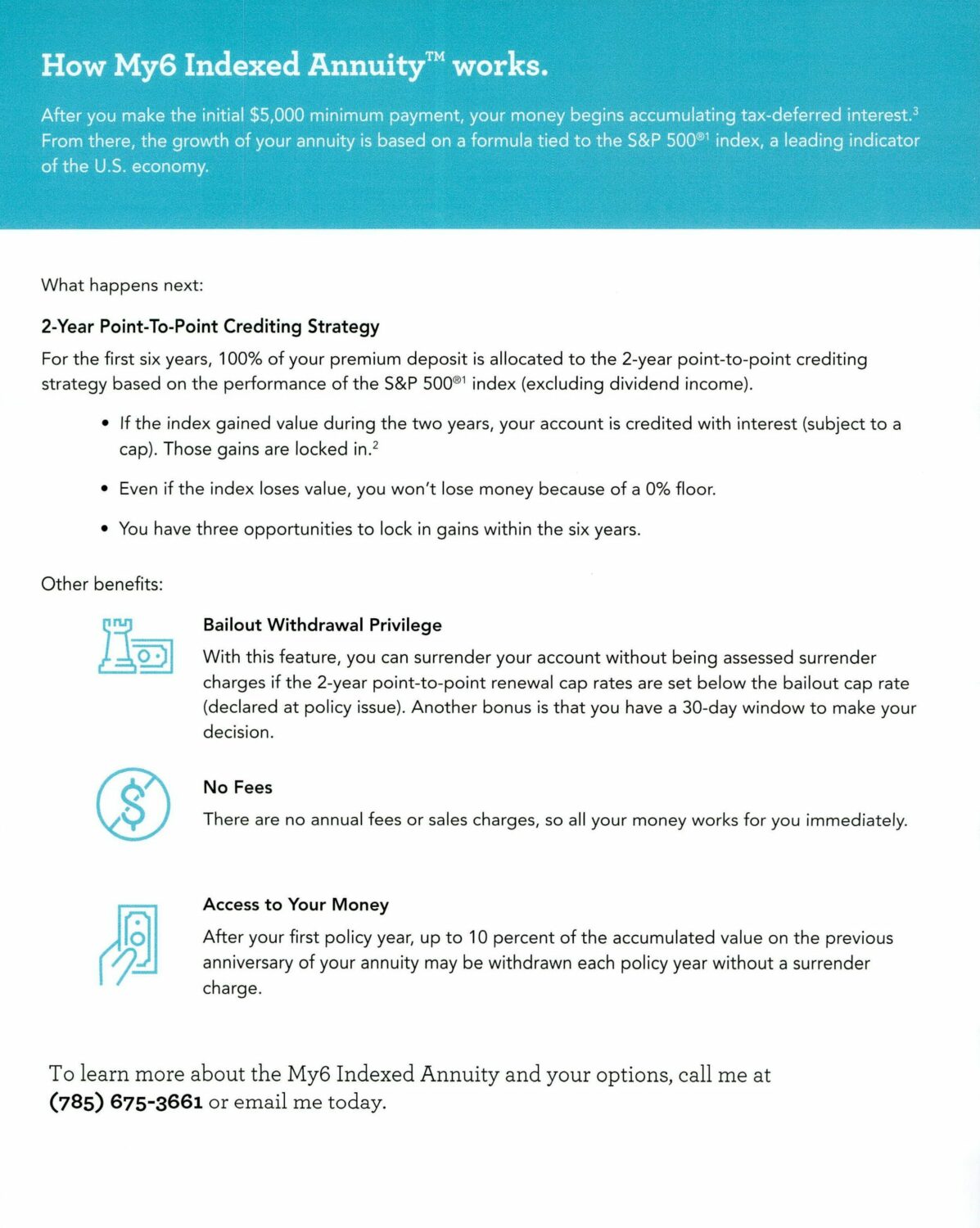

Meanwhile, a Farm Bureau Insurance mailer extended “a new opportunity for growth,” promoting its My6 Indexed Annuity. The mailer offered an explanation of how the product works and the added benefits it comes with, like Bailout Withdrawal Privilege and zero fees.

Credit: Comperemedia Direct

In addition to all of these strategies, TIAA informed customers the economy was negatively impacting its CREF variable annuity accounts and included steps to take to avoid negative returns.

Credit: Comperemedia Direct

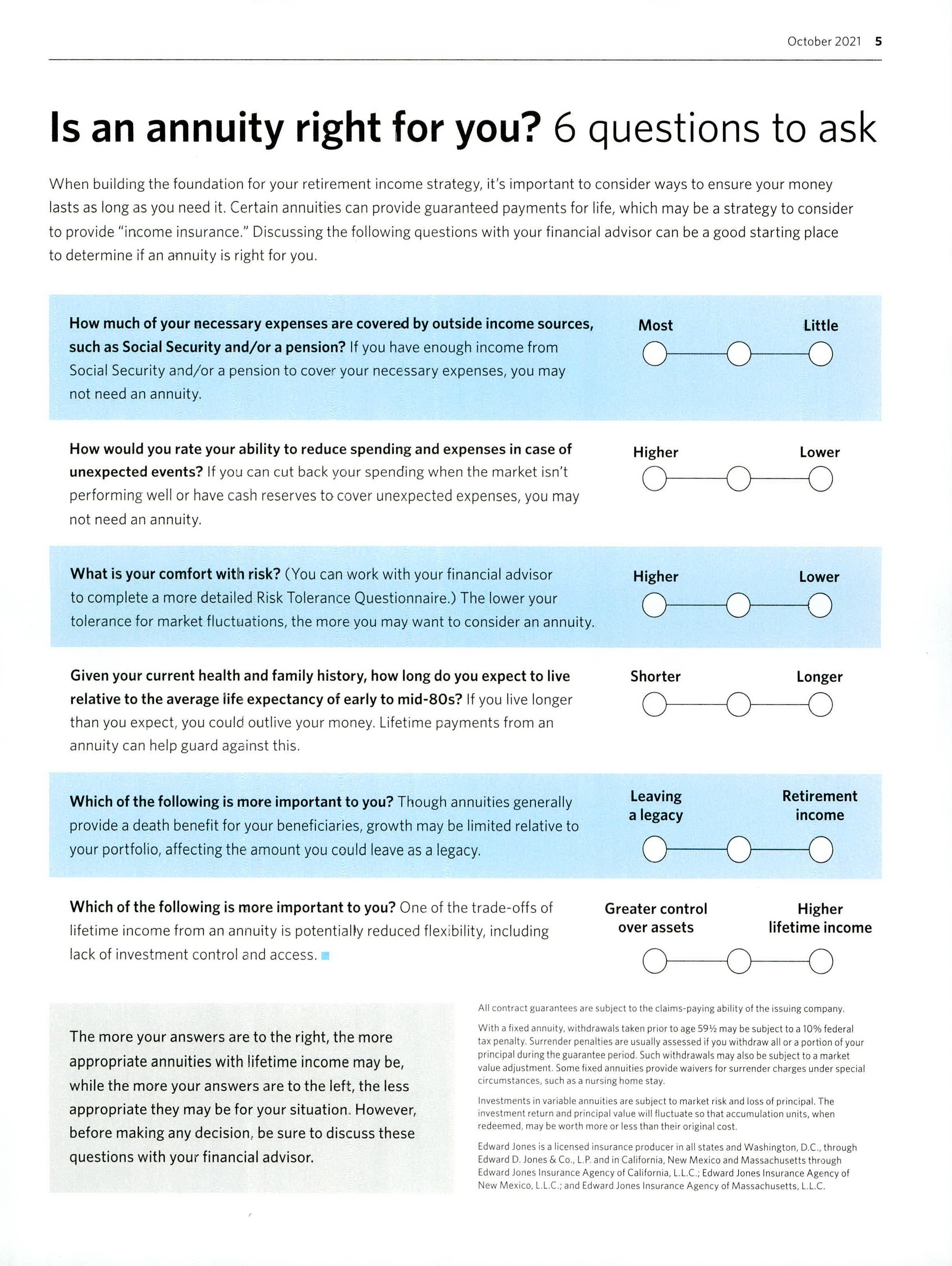

In a newsletter sent to customers, Edward Jones included six questions to ask a financial advisor to determine if an annuity is needed, positioning the product as an important consideration to “ensure your money lasts as long as you need it.”

Credit: Comperemedia Direct

Agent Examples

Protective Life Insurance sent agents income planning myths, in this case highlighting that one solution cannot fit the needs of every client. The company also encouraged agents to avoid a one-size-fits-all approach by offering them two guaranteed income solutions to offer their clients, a Protective Income Creator (fixed annuity) and a Protective Income Builder (indexed annuity.)

For CUNA Mutual, they encouraged their agents to give their clients more transparency and less complexity when promoting their annuity solutions.

In fact, in one mailer, the company highlighted that there is “no one-size-fits-all” path to retirement and that agents should give clients simple, transparent and easy to understand options. In another mailer, CUNA expressed that its fixed annuities could help deliver more confidence and clarity to clients.

Principal Financial, however, promoted its Pivot Series Variable Annuity, positioning it as a flexible, lower-cost, investment-focused option for clients.

Sort of like Protective Life Insurance, Brighthouse Financial sent agents a free Integrated Market Volatility Toolkit to “help boost client confidence” and keep their retirement plans on track. Prudential also sent their agents resources, sending multiple mailers to agents regarding its new product, Prudential FlexGuard Indexed Variable Annuity. Its initial mailer introduced the new product and highlighted that it “can help clients limit loss in down markets while enabling them to participate in innovative growth opportunities.” A follow up mailer elaborated further on the product and its benefits.

For their agents, Nationwide introduced a new digital tool that would help agents showcase how its Defined Protection Annuity would perform in “a variety of markets.”

Lastly, AlliAllianz offered its highest premium bonus ever at 25% as part of a limited-time Premium+ Event. The company included the bonus in a list of reasons agents should consider an Allianz Benefit Control Annuity for their clients.

Comperemedia, a Mintel company, is an industry-leading competitive marketing intelligence agency. To find out more about Comperemedia’s products and services, please get in touch.

Maegan Maloney

Maegan Maloney