This report serves as an overview of direct mail, email, online, and social media marketing among major life insurers in Q3 2021.

Life insurance mail volume was up both Q/Q (1%) and Y/Y (28%).

Mail volume reached its highest Q3 levels in two years, at 343 million. Insurers’ direct mail messaging was often focused on protection for loved ones with various calls to action, including simple next steps, debunking common misconceptions, and encouraging customers to lock in low rates sooner.

Ethos continued to stand out amongst the crowd.

Ethos’ against-the-grain approach stood out in both its messaging strategy and its channel distribution. Within direct mail, the life insurer highlighted its modern approach by encouraging prospects to get a free quote using a QR code because “we live in an age where you’re one click away from anything you want. Except life insurance.” From an omnichannel perspective, Ethos prioritized a top-of-funnel strategy, looking to boost its brand awareness through national TV ads. Other life insurers were focused on the bottom of the funnel, hoping to connect on a 1:1 basis.

Opportunity: Insurers should consider an educational approach to life insurance.

According to Amr Hamdi, Mintel’s U.S. Finance and Insurance Analyst, “for life insurers looking to extend their value propositions, going beyond the traditional messaging of mortality protection and blending more financial wellness education initiatives can bolster engagement and convey a more customer-centric ethos.” Brands like Ethos, Haven Life, and New York Life used marketing to reach the next generation of life insurance buyers by offering educational resources and elaborating on some of the basic concepts of life insurance.

Overall, life insurance mail volume saw a 28% increase year-over-year, thanks to seven out of the top ten mailers increasing volume. Lincoln Heritage continued to see a substantial increase year-over-year, increasing mail volume by nearly 25M. However, the life insurer decreased its mail volume quarter-over-quarter, dropping 14%. Ethos maintained its number ten spot within the top mailers, continuing to increase its mail volume which was up 38% quarter-over-quarter, and 2757% year-over-year.

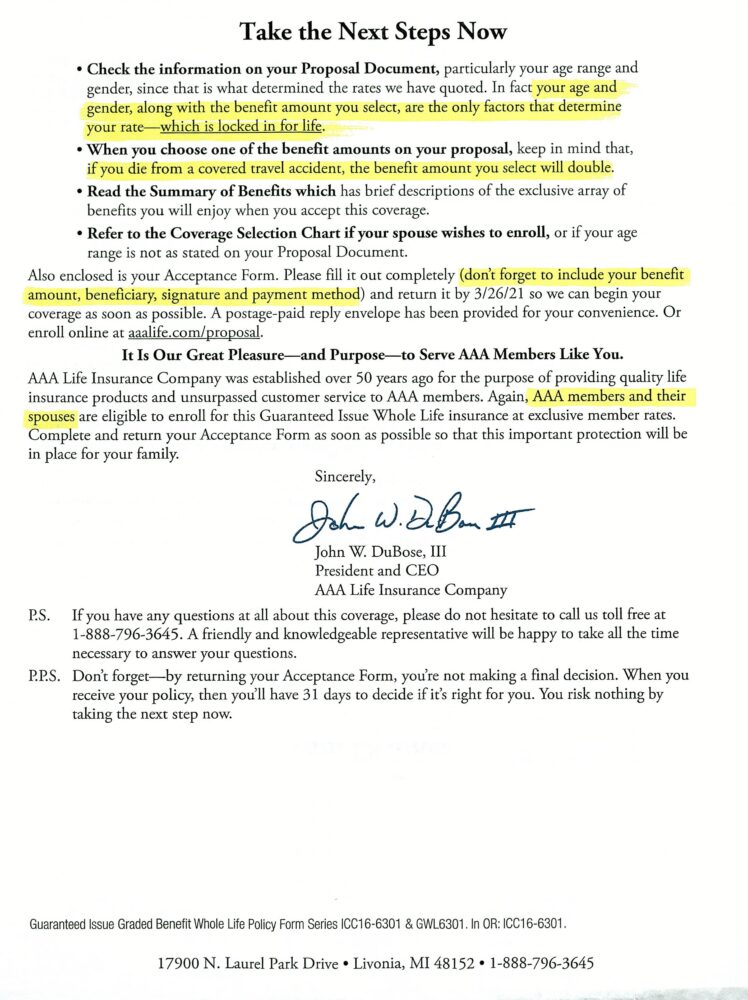

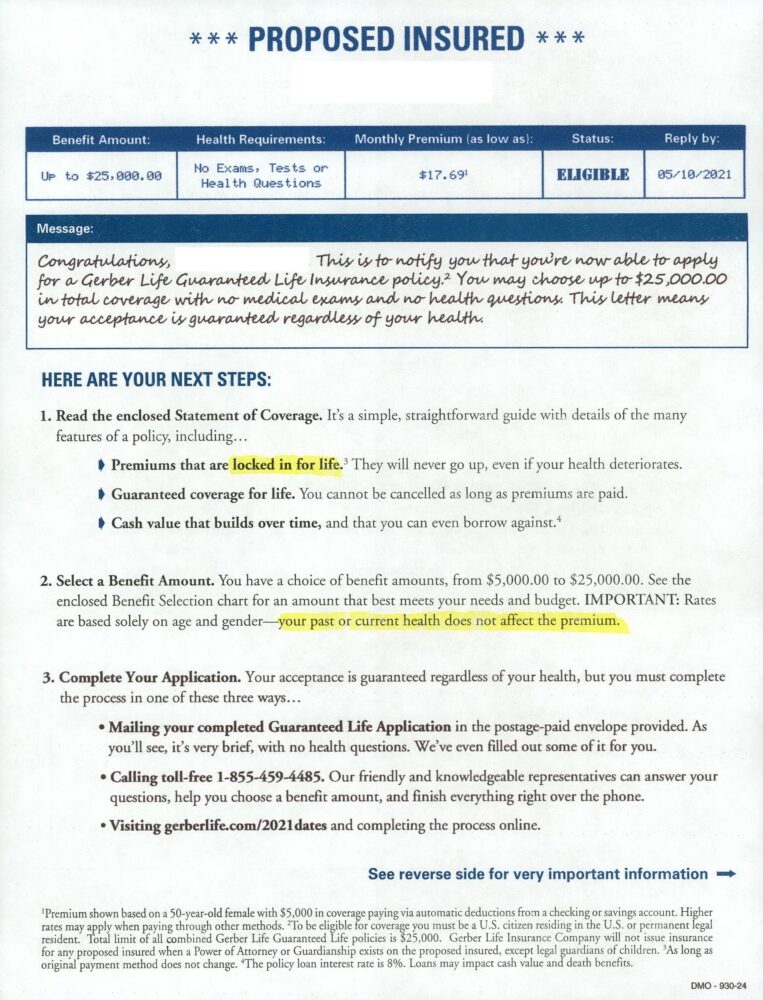

In their direct mail campaigns, life insurers left no room for confusion by laying out the next steps customers needed to take to obtain coverage, such as these campaigns from AAA Life and Gerber Life.

AAA Life | Credit: Comperemedia Direct

Gerber Life | Credit: Comperemedia Direct

Brands also encouraged customers to get coverage younger to lock in lower rates. A quote from USAA reads, ““Getting life insurance while you’re younger means you’re likely to find better rates. So stop putting it off. This year, put protection in place.”

Credit: Comperemedia Direct

In addition to that, Ethos and Mutual of Omaha addressed common life insurance misconceptions. Ethos included an expectation versus reality comparison to address misconceptions like having to go through an agent to get coverage.

Credit: Comperemedia Direct

Meanwhile, Mutual of Omaha used a myth versus facts comparison to debunk topics like life insurance being difficult to get when you’re over 45 years old.

Credit: Comperemedia Direct

As another alternative, New York Life targeted new-to-life-insurance customers by providing a brief overview of common life insurance questions. Their direct mail campaign broke down questions about cost, how it works, and how much you need it.

Credit: Comperemedia Direct

Additionally, Ethos touted its modern approach to life insurance by highlighting quick applications through QR codes, prices as low as “a nice dinner,” and an above average NPS score. A quote from their direct mail piece reads, “We live in an age where you’re one click away from anything you want. Except life insurance: one of the most important tools you can use to protect your loved ones.”

Meanwhile, Mutual of Omaha continually refreshed the creative for its whole life insurance ads but stuck to its core messaging: protection for your family at an affordable price. It utilized quotes like “…this life insurance offers you an affordable way to be there for your family at a time when they need someone most.”

Insurers also partnered with Fintechs to educate customers on budget-friendly insurance solutions and encouraged them to get a quote.

For example, SoFi and Ladder teamed up, touting a $500,000 term life policy for as little as $22/month. Meanwhile, Stash offered customers a $5 bonus when they submitted a quote with Bestow.

Credit: Comperemedia Direct

For Gerber Life, it targeted parents of college students as a new school year approached and encouraged them to take advantage of its College Plan. This campaign in particular featured the subject line, “Flexible college planning & adult life insurance benefits.”

Credit: Comperemedia Direct

Touching back on Mutual of Omaha, it emphasized its low $8.80/month cost alongside ways a whole life policy can help pay family expenses.

Similar to New York Life, Haven Life took an educational approach in emails, encouraging customers to learn more about a variety of life insurance topics to help make informed decisions about their policies.

Credit: Comperemedia Direct

AIG Direct utilized the trope that insurance is not one size fits all. AIG Direct positioned its term life insurance as a customizable solution “that fits your unique needs.”

Omnichannel Review

Research shows that life insurance paid media spend dropped to its lowest amount for 2021 in September, at $73.8M. However, spend for permanent (+5%) and term life (+6%) policies increased Q/Q. However, as seen in the previous quarter, nine out of 10 of the top life insurers spent most in direct mail. Meanwhile, Ethos reallocated spend from online video to TV, likely looking to reach a wider audience.

For example, USAA centered its life insurance messaging around family throughout the marketing funnel, especially emphasizing its $12/month price as a reason to get coverage immediately.

Comperemedia, a Mintel company, is an industry-leading competitive marketing intelligence agency. To find out more about Comperemedia’s products and services, please get in touch.

Maegan Maloney

Maegan Maloney