Mortgage acquisition mail volume has hit the highest level in two years, with mortgage and refinance offers touting record low rates. The rates soared in June 2021, up 20% from May 2021 and 113% from June 2020.

Top-volume campaigns promoted low rates on both new mortgages and refinancing, suggesting that now is the time to act.

Credit: Comperemedia Direct

Credit: Comperemedia Direct

Credit: Comperemedia Direct

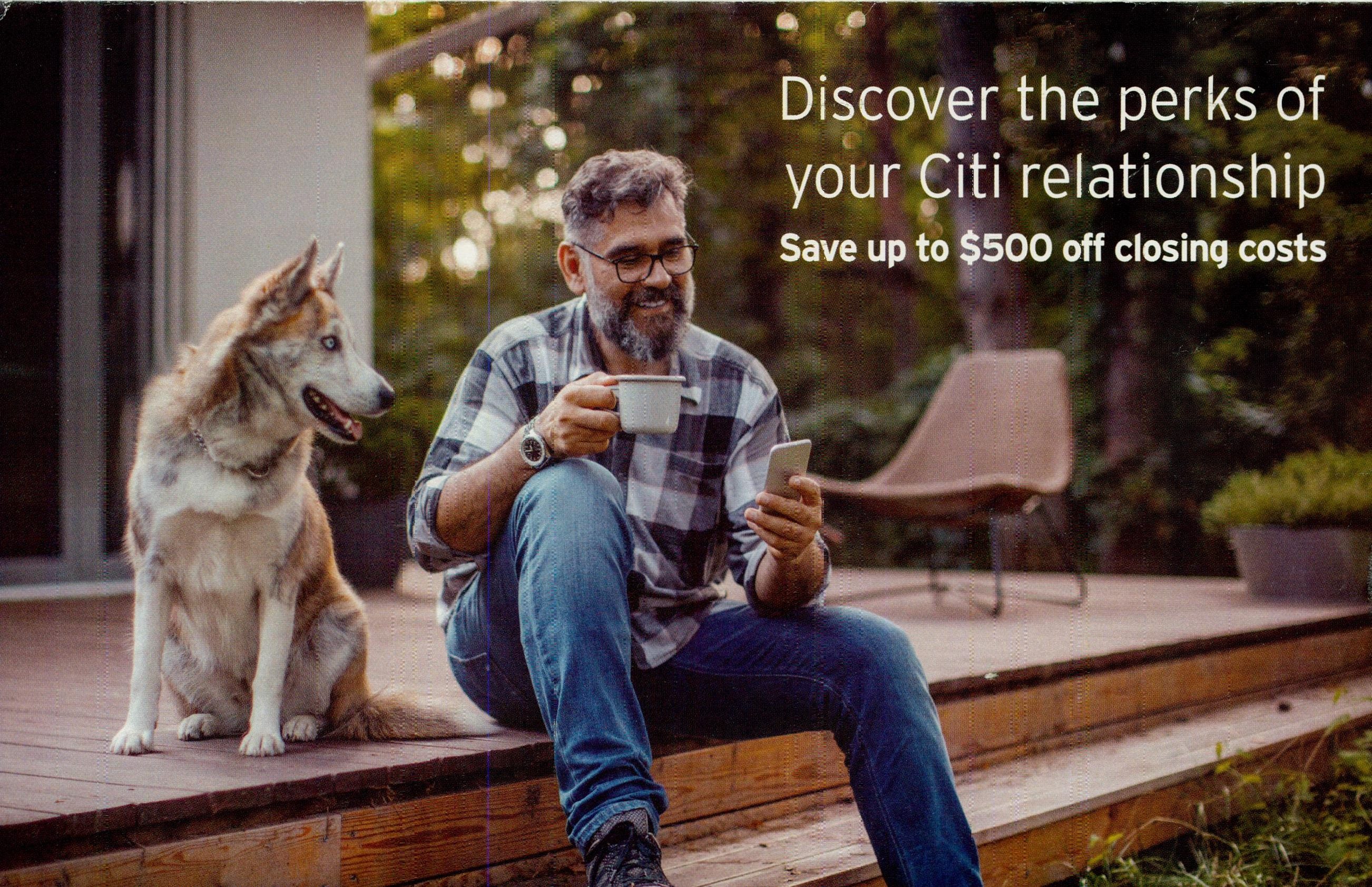

Some lenders targeted existing customers with mortgage and refinance offers, framing them as “perks” of the customers’ histories with the companies.

Credit: Comperemedia Direct

Given soaring housing prices and a competitive market, mortgage lenders would be wise to focus on how they can help homebuyers act quickly. Highlighting quick pre-approval and emphasizing how pre-approval can speed up the buying process, is a step in the right direction. They could also continue to emphasize low rates and discounts on closing costs, which could soften the blow of high home prices.

Comperemedia, a Mintel company, is an industry-leading competitive marketing intelligence agency. To find out more about Comperemedia’s products.

Rachel Arndt

Rachel Arndt