In the past year, student loan providers addressed the uncertainty around the classroom setting, offering support outside regular value propositions. They had the opportunity to provide transparency, empathy, and additional support that went beyond the services they originally offered. In this report, we explore different campaigns that addressed these opportunities.

Changing Perspectives on Higher Education

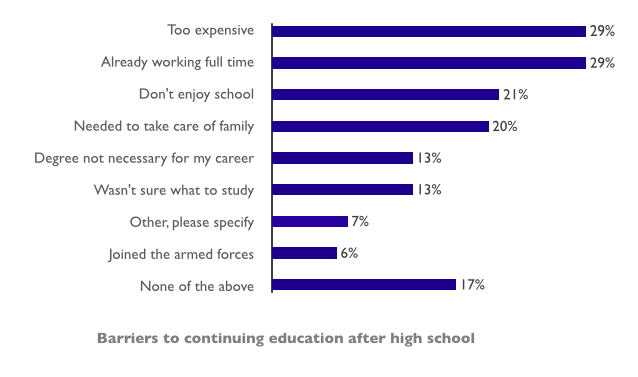

With the cost of college rising and the uncertainty around in-person classes, lenders can anticipate more hesitation around higher education.

According to Sallie Mae’s 2020 survey How America Pays for College, “thirty-eight percent of families say financial considerations, such as the total cost of attending or the financial aid package, were the deciding factor in their final choice.” Additionally, in a survey of more than 13,000 students by the study guide platform OneClass, 93% of students said tuition should be lowered if classes go completely online. Lenders should be fully aware of this consumer sentiment and adjust their packages accordingly to alleviate borrowers’ anxieties, pushing to show the value of higher education to potentially offset the costs.

Marketing Activity in 2020

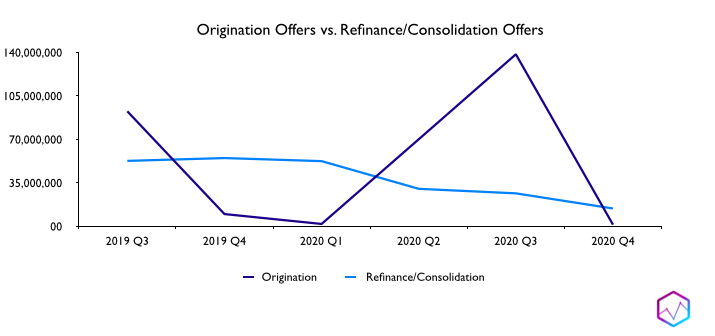

While refinance and consolidation offers continued on a downward trend from Q1 2020, origination offers peaked in Q3 2020, with the largest mail volume in the past two years.

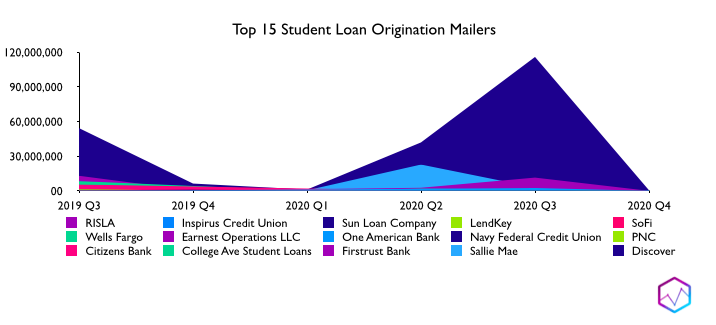

The student loan origination landscape had its largest increase in overall mail volume in Q2 2020, up nearly 36x Q/Q. Discover was the primary driver of this increase, boosting mail volume by almost 74 million offers in Q3 2020. New within the landscape last year were Inspirus, RISLA, and Sun Loan One American Bank, which were not present in 2019.

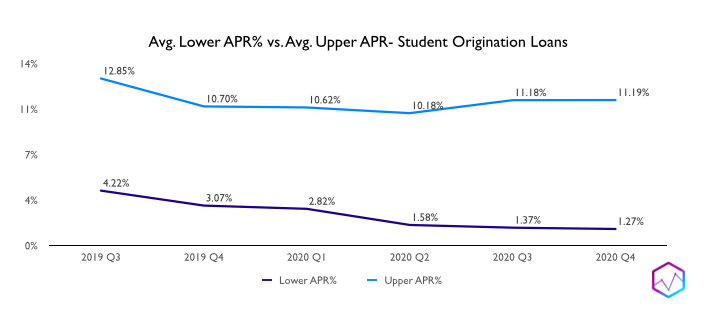

In an effort to stimulate the economy, the Fed slashed interest rates during the COVID-19 crisis. Student loan interest rates fell to historic lows, especially in the latter half of 2020. In comparison, the lowest average APR in the past two years was 3.62% back in Q1 2018.

While Sallie Mae made up half (49%) of 2019’s email acquisition share of voice, SoFi went from 9% to 30% 2019-20 and impeded on Sallie Mae’s share with emails touting a welcome bonus for refinancing customers. Lenders such as Experian, PNC, Credit Karma, and Nelnet entered the email landscape in 2020 (with 3% or less share of voice respectively), seeking to reach customers outside of direct mail.

Based on keyword analysis, student loan issuers leveraged the word “help” the most in 2020, indicating their efforts to proactively reach out to new and current customers for guidance. However, terms like “extension” and “relief” over indexed in read rates, signifying consumers’ demand for immediate financial support.

“Help” had a sum of 125 million in project volume with a total weighted average read rate of 14.6%. “Extension” and “relief” had 19 million with a rate of 43.5% and 2.4 million with a rate of 50.5%, respectively. “Coronavirus” also topped the list with a sum of 4.8 million in project volume with an average read rate of 40.9%.

Messaging was Key in Acquisition Campaigns

Discover sent the most acquisition mail by far, with top mail campaigns focusing on covering 100% of college costs along with 24/7 support. It utilized consistent messaging of cash rewards, lack of fees, and covering big expenses such as tuition, housing, and books.

Credit: Comperemedia Direct

By acting as the primary driver of the direct mail landscape and highlighting these value propositions consistently, Discover positions itself as a major lender, offering support, trust, and financial guidance for those looking to pursue higher education.

Credit: Comperemedia Direct

Sallie Mae, College Ave Student Loans, and Citizens Bank were among other top mailers in 2020. Messaging emphasized options, customization, and parent loans.

Sallie Mae highlighted its competitive fixed or variable interest rates, providing options that work best for the customer.

Credit: Comperemedia Direct

College Ave encouraged borrowers to visit its online calculator to create their own customized loan to fit their budget and life.

Credit: Comperemedia Direct

Citizens spoke to parents directly, encouraging them to look into the Citizens One Student Loan for Parents, positioning it as an alternative to the Federal PLUS loan.

Credit: Comperemedia Direct

Earnest (One American Bank) sent a campaign maximizing the space on both the front and back of the envelope to get its value propositions across.

Credit: Comperemedia Direct

Credit: Comperemedia Direct

The lender strategically used terms such as “Earnest Advantages,” and “Client Happiness Team” to make these loan features brand-specific to Earnest. The firm also touted its 5-star rating from Trustpilot along with the amount of active clients on the outer envelope to make the solicitation more trustworthy.

According to Mintel data, “56% of Millennials look to online reviews to learn about products they are interested in.” The lender caters to this sentiment by leveraging its Trustpilot Rating as one of the first consumer touchpoints.

Transparency is Paramount

Transparency, in particular, is necessary during uncertain times. With the distribution of government stimulus packages, the CARES Act directly affected many student loan borrowers.

For example, FedLoan Servicing formally alerted student loan customers to the provisions within the CARES Act and how the loan servicer would be addressing them. By contextualizing the recent stimulus package to borrowers’ current payment status, the lender provides transparency and assurance for its customers.

Credit: Comperemedia Direct

Lenders should prioritize similar actions by immediately notifying customers of what to expect with changing government policies around student loans.

Other providers, like PNC, SoFi, and Credible, urged email recipients to check their potential rates on their student loans.

PNC touted its PNC Solution Loan: a private loan built to cover expenses outside of financial aid. The email used bold and enlarged text to draw the reader’s attention to “see our competitive rates today.”

Credit: Comperemedia Direct

SoFi incentivized new customers to check their rate on a Private Student Loan with a $10 reward.

Credit: Comperemedia Direct

Credible kept its solicitation short and to the point, urging new customers to check rates in order to take advantage of student loan rates at historic lows.

Credit: Comperemedia Direct

The email also included a Client Success representative with her name and phone number as a way to make the application process feel more personal and helpful.

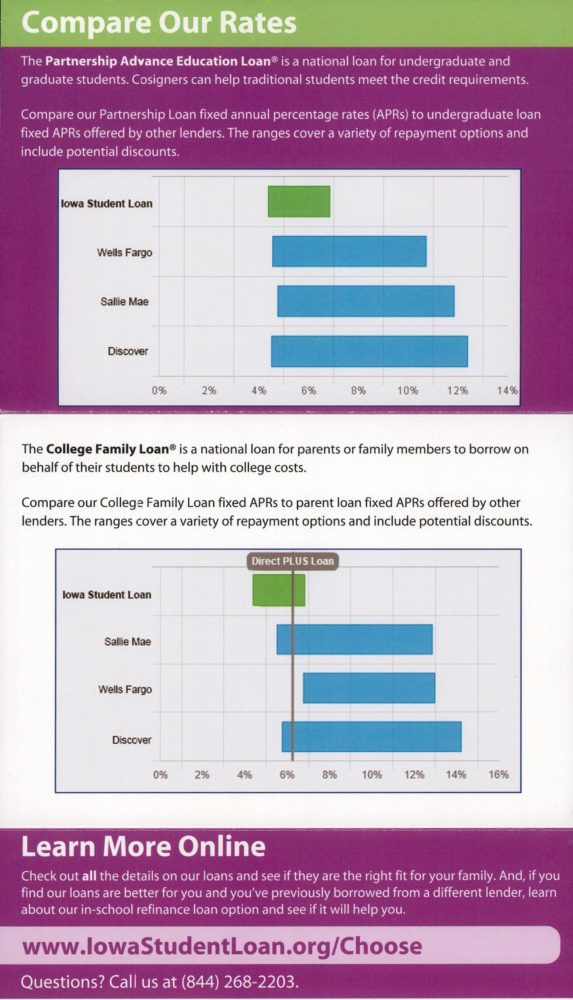

Iowa Student Loans reached out to customers acknowledging that “paying for college may be more challenging than usual.” The mailer also included comparisons against other major lenders, providing customers with more visual context.

Credit: Comperemedia Direct

By addressing the current state of the economy and empathizing with customers, Iowa Student Loan positions itself as more of a supportive lender in comparison to its other big name competitors.

Shift in Learning Environment

Another result of the pandemic was that students were overwhelmingly required to shift their learning environments out of the classroom.

As campuses transitioned to an entirely digital learning experience, students were forced to adjust rather quickly. Lenders such as Navy Federal, SoFi, LendingTree, and College Ave Student Loans addressed the subject head on, acknowledging the shift to online courses. Lenders must be willing to accommodate their products and services to the changing learning environments for college and university students.

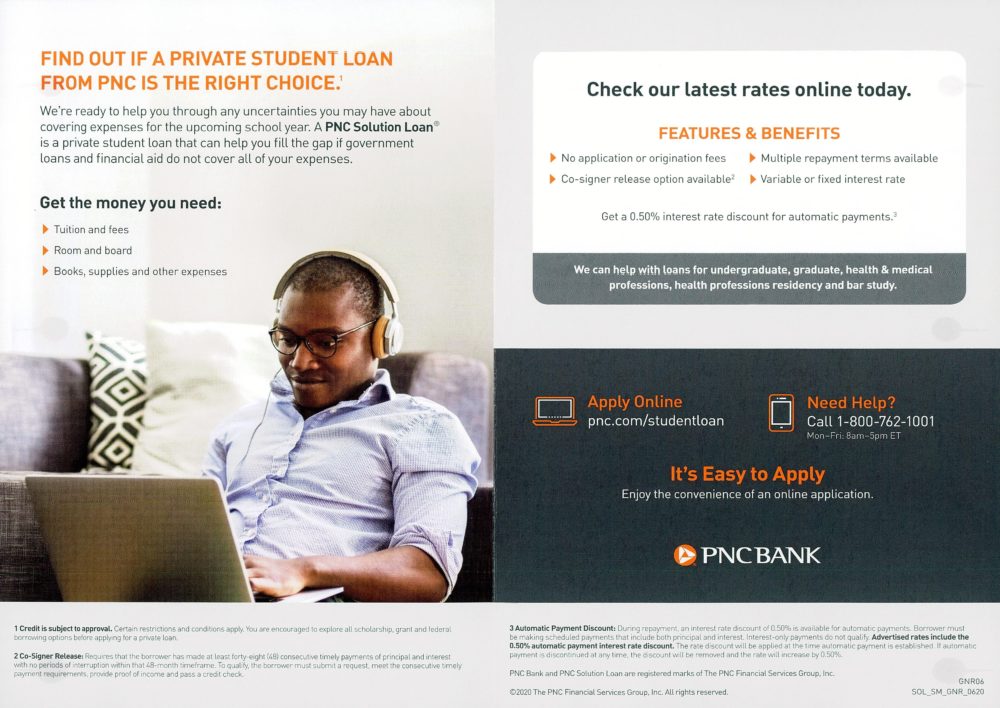

PNC advertised its PNC Solution Loan in this printed campaign, as well, as a private student loan built to “fill the gap if government loans and financial aid do not cover all of your expenses.”

Credit: Comperemedia Direct

Coincidentally, PNC and Navy Federal used the same visual when promoting their respective student loans. However, Navy Federal specifically addressed classes being online or in person.

Credit: Comperemedia Direct

The PNC campaign was mailed as early as June with almost three times the amount of mail volume compared to Navy Federal’s mail campaign on a product level.

LendingTree and College Ave Student Loans directly addressed the transition to online courses, offering students financial and technical support.

Credit: Comperemedia Direct

Credit: Comperemedia Direct

Additional Support

In 2020, it became important to cater support to students beyond financial offers.

Though financial guidance during a critical time is crucial, lenders can garner stronger customer relationships by providing other resources.

Discover offered customers a free trial to Story2, an educational technology company. With this strategic partnership, Discover aligned its student loan products with a free, innovative, and valuable resource for its customers.

Credit: Comperemedia Direct

College Ave Student Loans mailed customers a brochure, outlining various financial aid tips. It aimed to bring more awareness around the financial aid process, encouraging customers to apply for the FAFSA regardless of their income. The mailer also urged new customers to enter to win a $1,000 scholarship for additional support.

Credit: Comperemedia Direct

CollegeSTEPS newsletters from Wells Fargo consistently updated recipients with the most recent student loan information intended for parents.

Credit: Comperemedia Direct

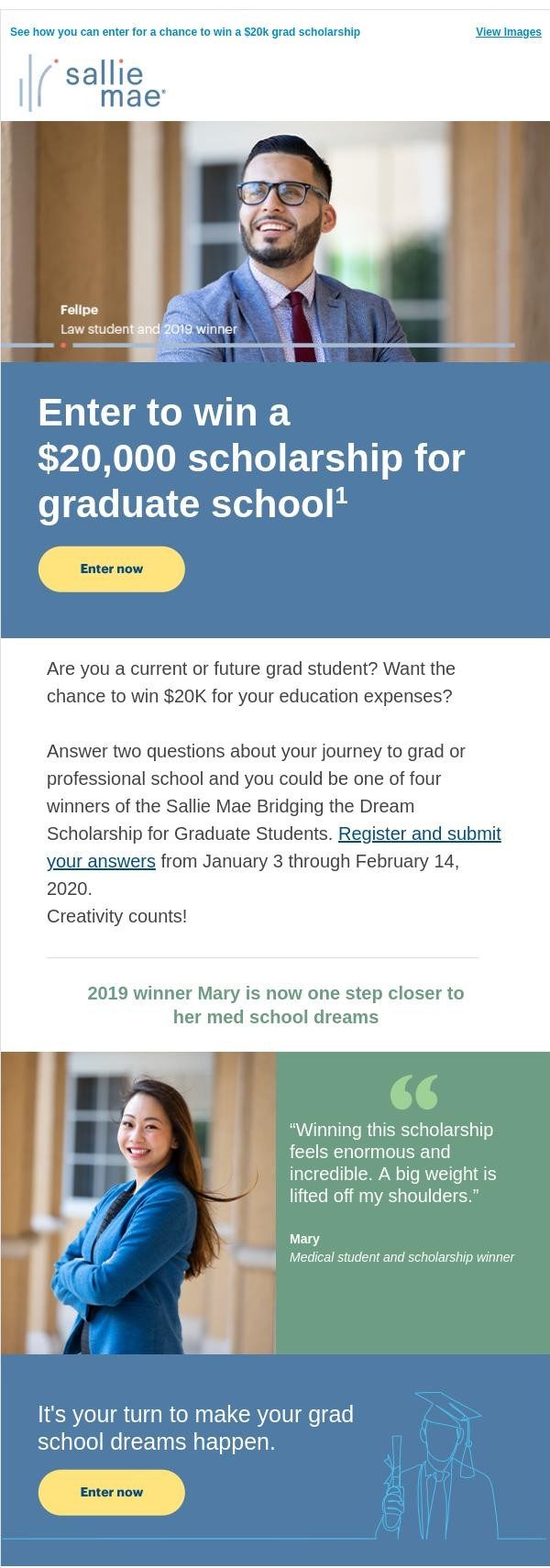

SoFi and Sallie Mae specifically addressed grad school students, offering them an easier application process along with a scholarship for up to $20,000.

Credit: Comperemedia Direct

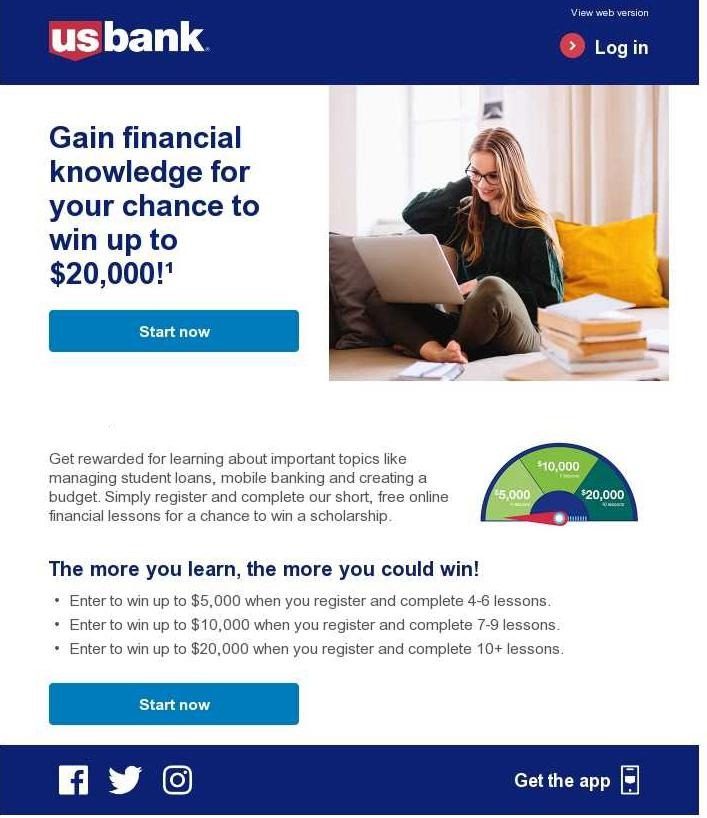

U.S. Bank also incentivized customers with a chance to win up to $20,000 depending on the amount of free online financial lessons they take. By rewarding customers for enhancing their financial literacy, U.S. Bank provides a worthwhile educational experience.

Credit: Comperemedia Direct

SoFi introduced its Brand Ambassador program for upcoming college students in an effort to turn its customer base into avid ambassadors for its products and services.

Credit: Comperemedia Direct

These all show how different consumer touchpoints can add value to the lender’s relationship beyond financing.

Comperemedia, a Mintel company, is an industry-leading competitive marketing intelligence agency. To find out more about Comperemedia’s products and services, please get in touch.

Christina Han

Christina Han