Credit card welcome kits should serve two main purposes: to educate and to remind cardholders why they chose the card. In this credit card welcome kit competitive review, we look at best practices and examine eight specific products and their related welcome kits.

Educating the Cardholder

The welcome kit should first and foremost serve as a guide to help the cardholder get the most out of their credit cards.

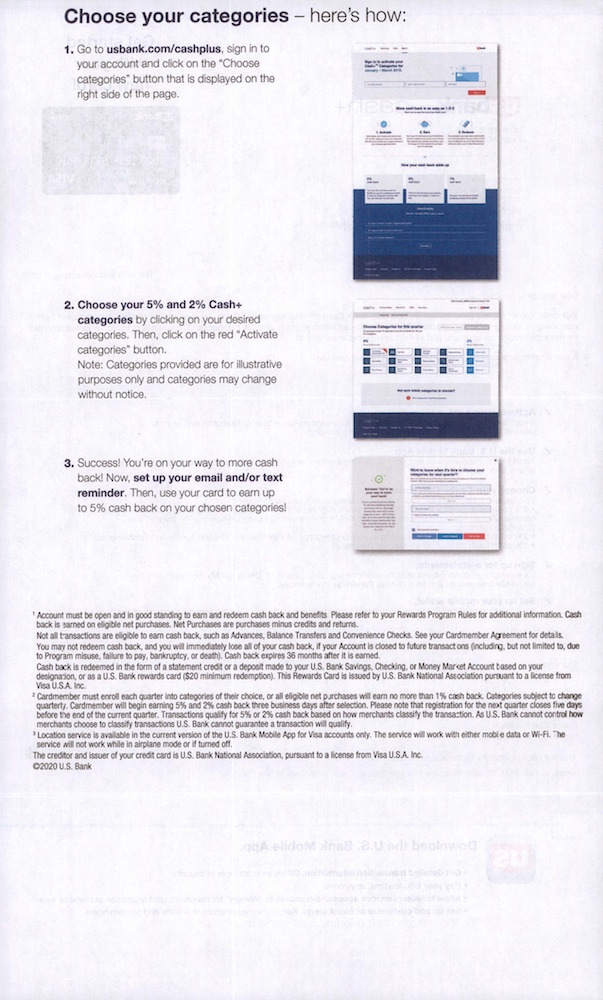

For example, Bank of America and U.S. Bank relied on step-by-step guides and checklists to make the learning curve less steep, allowing customers to start using the card efficiently right away.

In the Bank of America Cash Rewards program example, the copy focused on motivating cardholders to activate the card and educate them on how to use the card properly in order to take full advantage of it. It also emphasized the card’s flexible 3% category and although other benefits were mentioned, they were found in the fine print.

Credit: Comperemedia Direct

U.S. Bank focused specifically on educating new cardholders on how to earn “the most cash back right away” in the U.S. Bank Cash+ program. U.S. Bank used images to supplement its step-by-step guide to choose the 5% and 2% categories, providing cardholders a visual aid and making the process more approachable and simple.

Credit: Comperemedia Direct

Remind Cardholders Why They Made Their Choice

An important objective of welcome kits is the need to remind cardholders of the card’s main value proposition and its ancillary benefits.

U.S. Bank does a good job of reassuring cardholders about their decision by stating that “[They] have made a great choice” by choosing their card, and immediately reminds the customer what the value proposition of the product is. In an environment where there are so many options, it would be a good idea to help customers avoid buyer’s remorse and reassure them of the choices they have made.

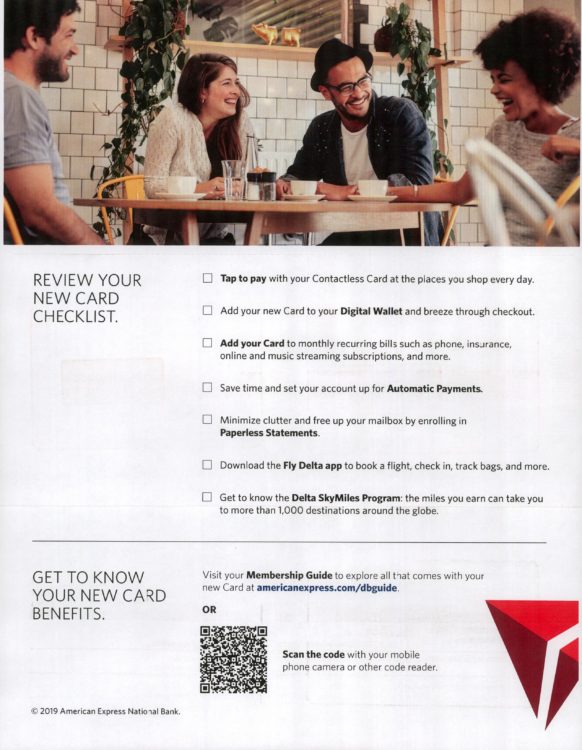

The main focus of the American Express Blue Delta SkyMiles welcome kit was twofold – for customers to review their new card checklist and for them to get to know the benefits of their card. It closed the gap between physical and digital by including a QR code in its welcome kits. The code could be scanned to access the card’s membership guide. In addition to this, the welcome kit included a visual one pager summarizing the card’s benefits, making it easy for cardholders to find all the card’s benefits in one place.

Credit: Comperemedia Direct

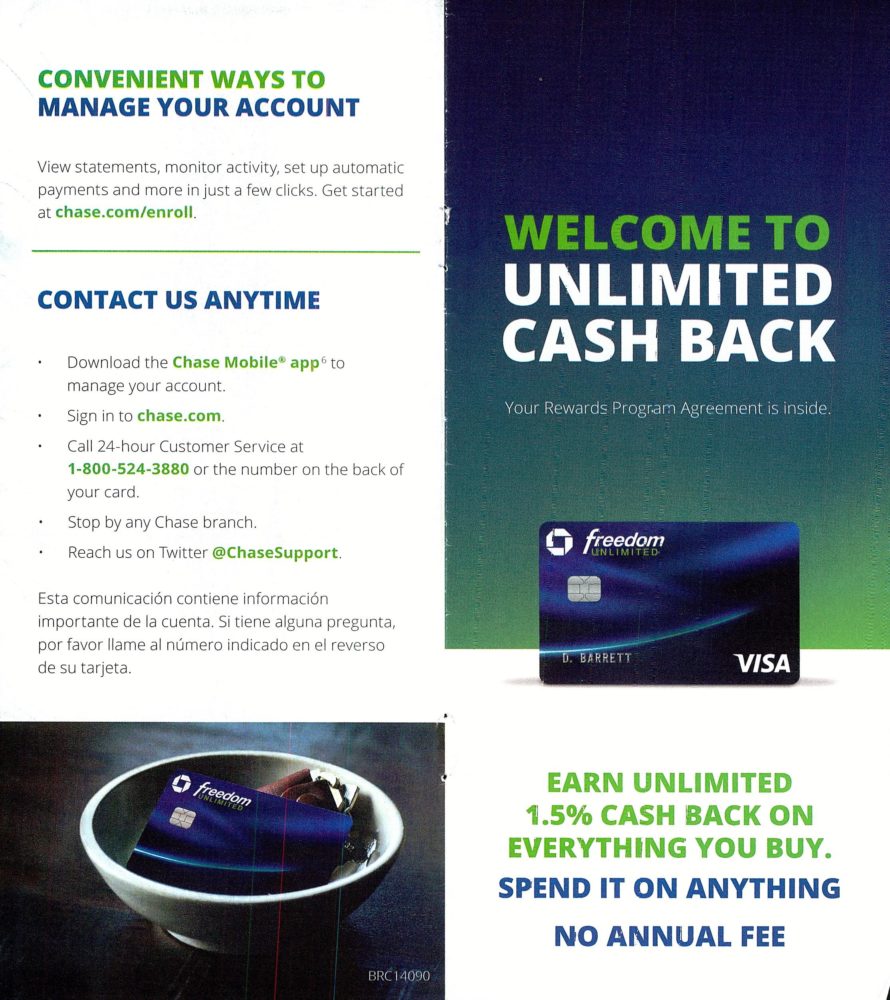

Focusing on both main and ancillary benefits of the card made the Chase Freedom Unlimited welcome kit both thorough and comprehensive. And the use of images emphasized these benefits.

Credit: Comperemedia Direct

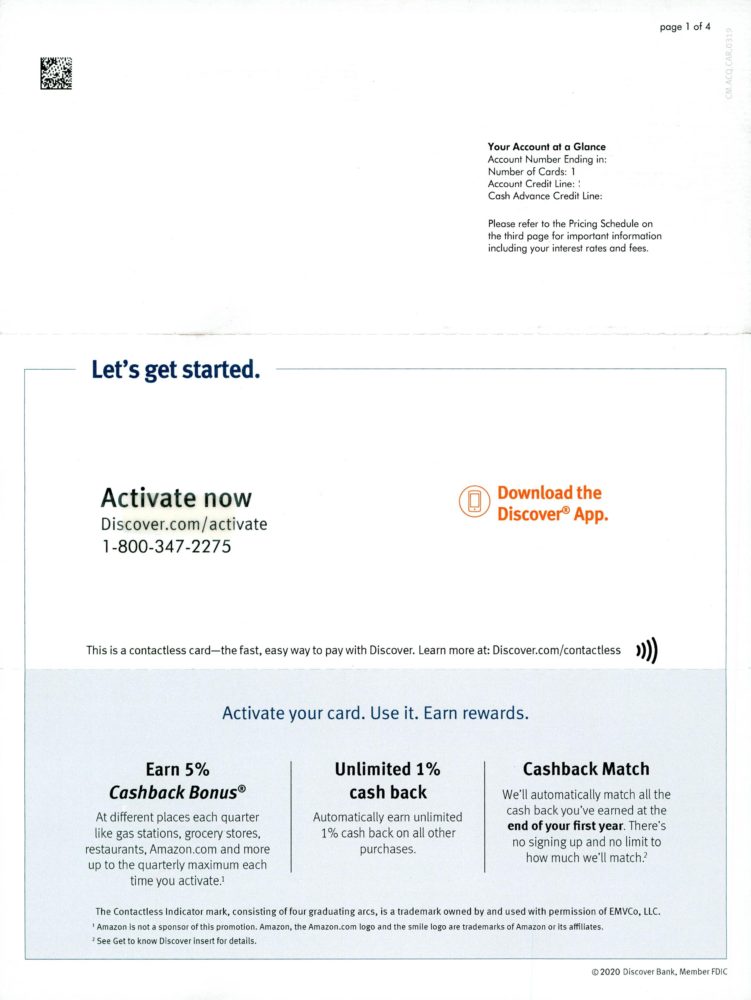

Despite being an ancillary benefit, Discover honed in on its tap-to-pay feature. It focused on simplicity with the line “activate your card. Use it. Earn rewards.” The main page of the welcome kit also highlighted the card’s reward structure, including Discover’s Cashback Match.

Credit: Comperemedia Direct

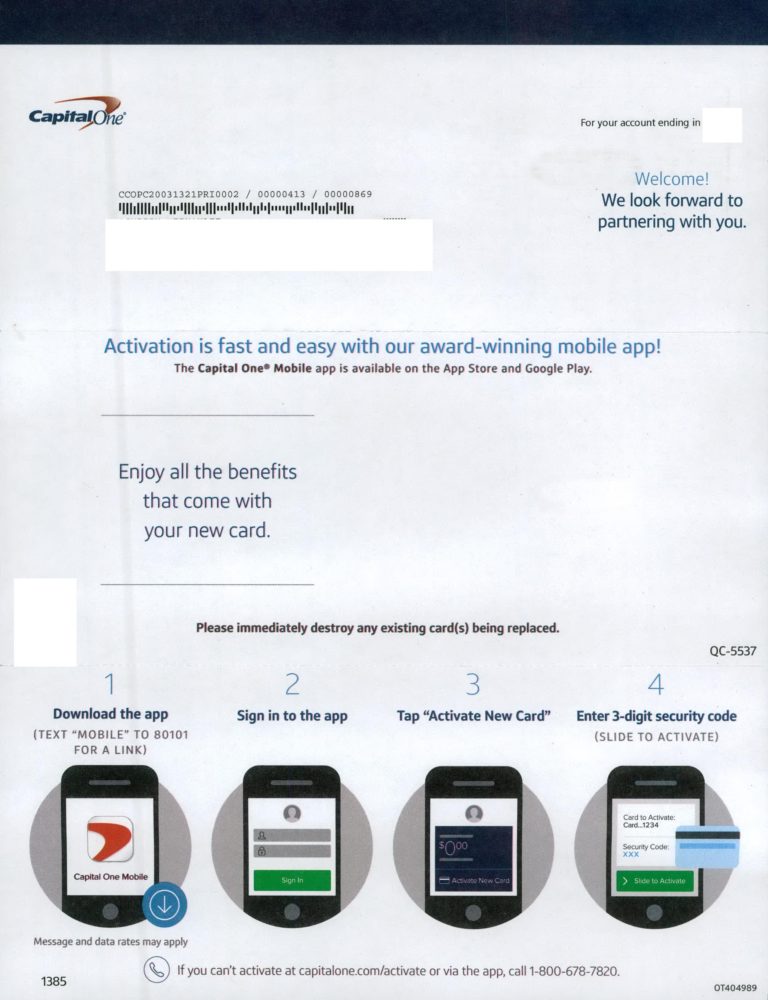

Capital One took a different approach by revolving around the mobile-first activation process and not specifically the card’s benefits. Although the welcome kit did include some imagery, it was limited to the step-by-step activation guide. Aside from that, the communication was very text heavy.

Credit: Comperemedia Direct

Use of Imagery Makes Benefits Stand Out

Beyond just explaining the benefits of a credit card in a text heavy kit, the use of images and icons can help cardholders better understand the value proposition of their card.

The Citibank AAdvantage MileUp welcome kit relied heavily on travel-related imagery to showcase a sense of lifestyle that resonated with the cardholder. The combination of images and light text utilized by Citibank make it easier for cardholders to become acquainted with their new card without having to read through text-heavy pages, thus making the onboarding experience much more enjoyable.

Credit: Comperemedia Direct

It also accentuated the card’s value proposition and reminded cardholders of all the benefits their new card possesses by focusing on explaining to customers how their new card would help them take off for their next vacation sooner rather than later.

Rather than using images, PNC opted to use icons as its visual cues for PNC Cast Rewards.The focus of the communication was to showcase the card’s reward structure and how cardholders can maximize their cash back every day.

PNC’s Mobile App, balance transfers, free additional cards, recurring bill payments, and tap-to-pay.

Comperemedia, a Mintel company, is an industry-leading competitive marketing intelligence agency. To find out more about Comperemedia’s products and services, please get in touch.

Esteban Duverge

Esteban Duverge