Recent studies show that health insurers often sent mailers directly to customers who were approaching their first ever Medicare enrollment period to lend a helping hand, offer comprehensive Medicare information, and tout valuable services in hopes of swaying customers to their services.

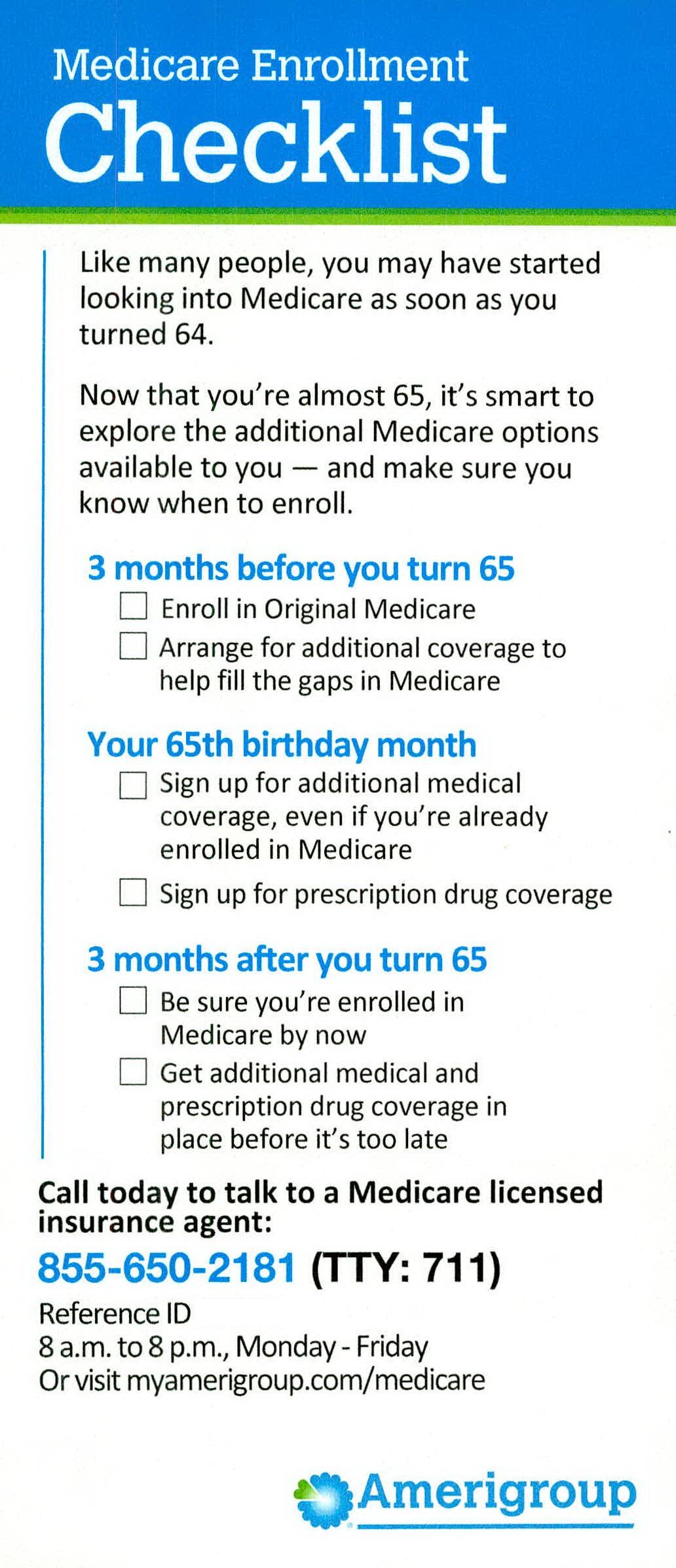

For example, Amerigroup proactively reached out to customers approaching their first Medicare enrollment period, offering comprehensive information, tips, and a checklist to help guide their decision.

Credit: Comperemedia

Similar to Amerigroup, Physicians Mutual reached out to first-time enrollees to promote its free Medicare guide. The insurer homed in on the importance of researching options, while calling attention to its unbiased and easy-to-understand resources.

Credit: Comperemedia

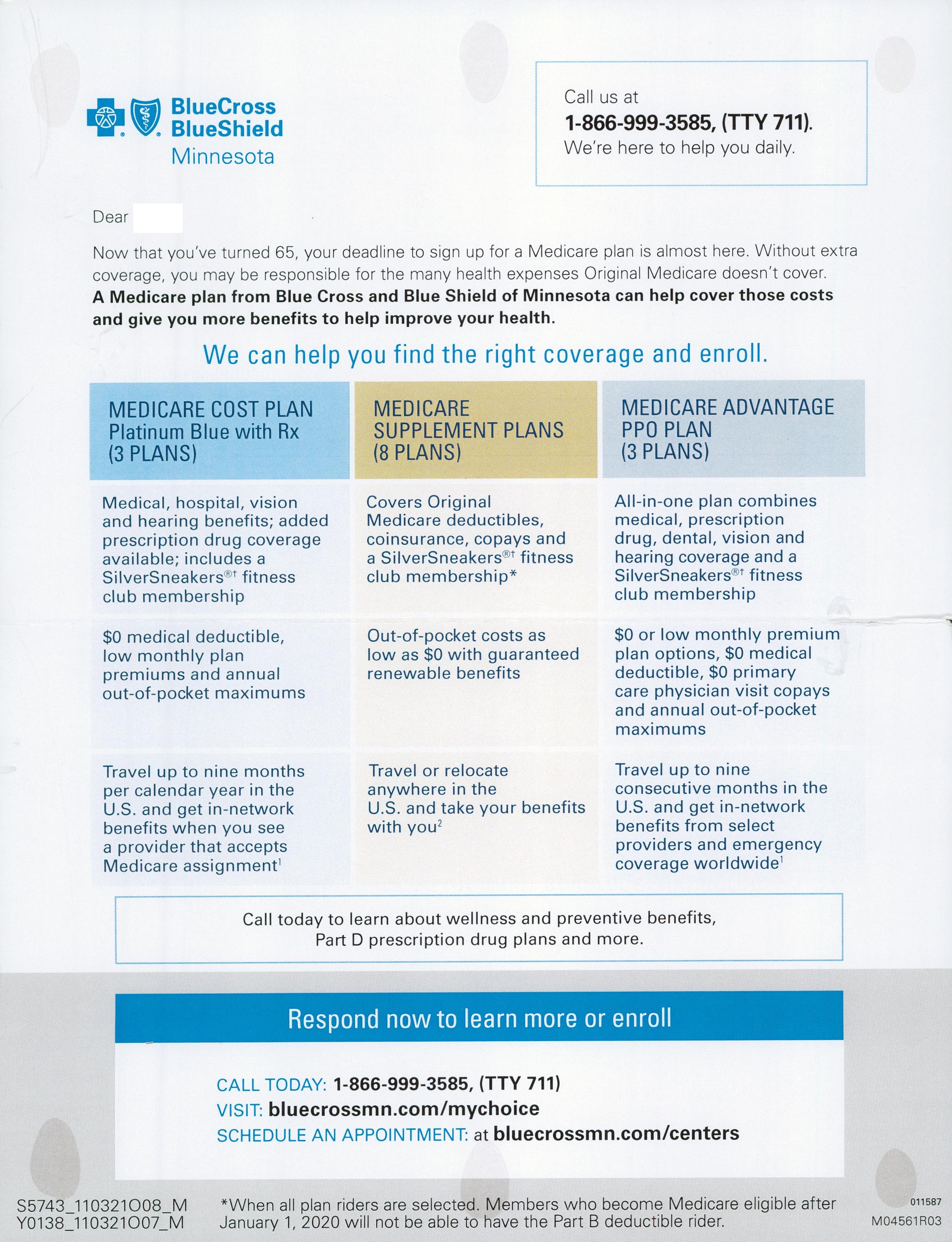

Meanwhile, Blue Cross Blue Shield insurers sought to break through the complexities of Medicare information and offer new-to-Medicare customers a helping hand. Blue Cross Blue Shield of Minnesota even went as far as to reach out to a customer following their 65th birthday to let them know their Medicare deadline was fast approaching. The mailer offered a breakdown of its Medicare Cost Plans, Medicare Supplement Plans, and Medicare Advantage PPO Plans to help provide clarity surrounding the gaps in Original Medicare.

Credit: Comperemedia

Blue Cross Blue Shield of Arizona spoke directly to new-to-Medicare individuals, affirming that Medicare information can be complex. The insurer offered a free, no obligation guide to help assist in their decision-making process. The mailer also homed in on the freedom and flexibility of its Supplement plans.

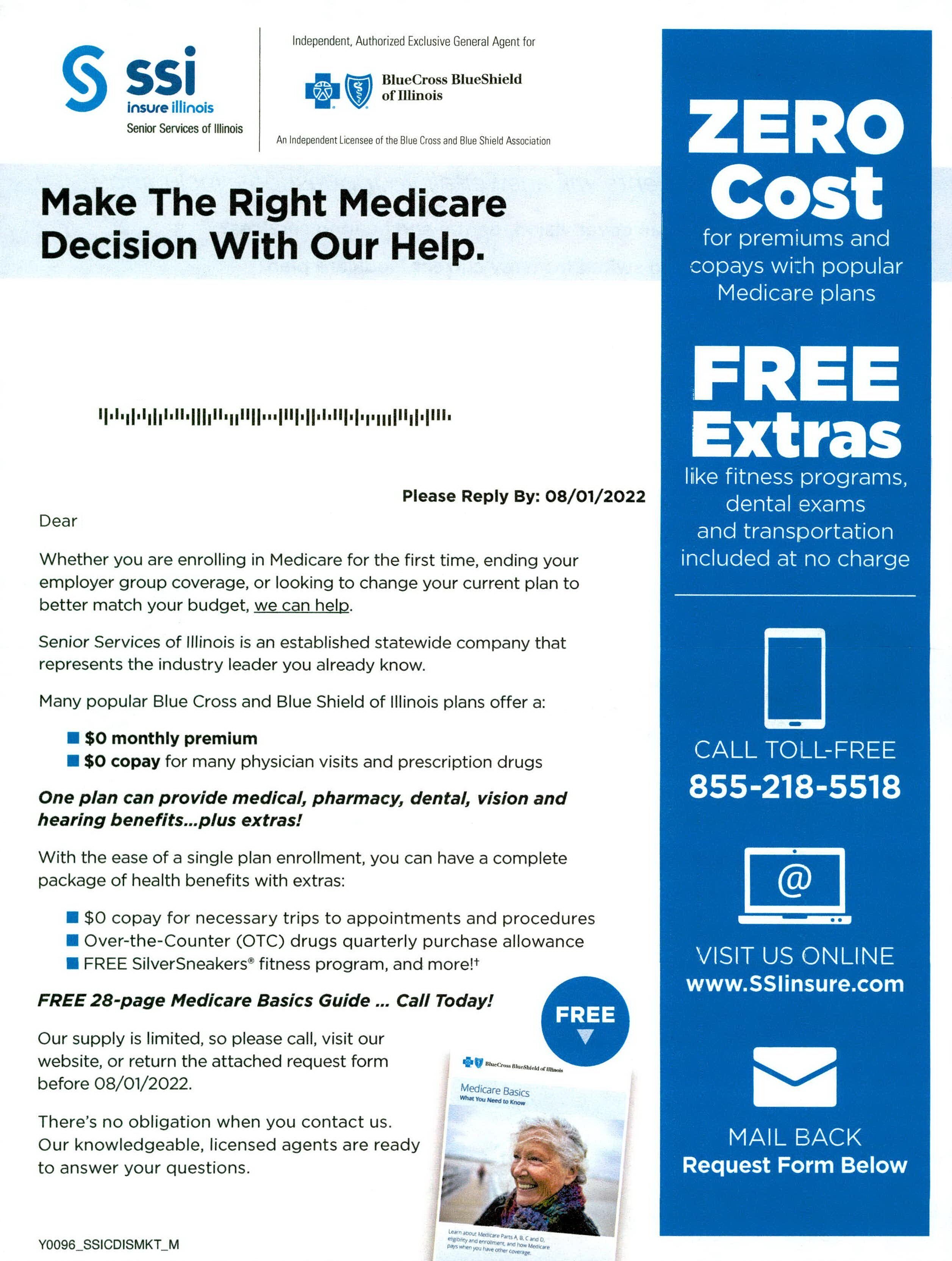

While not solely targeting new Medicare customers, several insurers did call attention to first time enrollees alongside notable benefits to sway customers to their services. For example, Blue Cross Blue Shield of Illinois emphasized its zero cost premiums/copays and free extras, like fitness programs. Meanwhile, Kaiser Permanente highlighted new coverages like annual preventive dental care and OTC health/wellness products.

What the experts think

Researchers believe that Beneficiaries aging into Medicare are more likely to need help understanding their coverage options, making it crucial for insurers to extend a helping hand.

According to Mintel data, 22% of consumers under the age of 65 agreed that they needed help understanding Medicare enrollment decisions. This was twice as high as those aged 65+ who had likely already taken part in a Medicare enrollment period. Expanding even further, 19% of those under 65 said that marketing materials impacted their enrollment decisions, which was 12 percentage points higher than those aged 65+.

Studies also show that consumers who are quickly approaching 65 are more likely to seek help when it comes to Medicare decisions. They are also going to be more impacted by marketing materials sent by insurers. Insurers will need to continue to take note and make sure that they’re offering resources to those who will be enrolling in Medicare for the first time. Free Medicare guides are quickly becoming table stakes.

Therefore, health insurers should consider offering checklists to help keep customers on track for enrollment or offer one-on-one sessions to help provide clarity. Insurers could even take it a step further by offering an incentive to new-to-Medicare customers for scheduling informational sessions with a licensed provider.

Comperemedia, a Mintel company, is an industry-leading competitive marketing intelligence agency. To find out more about Comperemedia’s products and services, please get in touch.

Maegan Maloney

Maegan Maloney